This is the second in my series about Mergers and Acquisitions. In my first white paper “How Poor M&A Panning and Execution Destroys Shareholder Value”, I explored the major value destroyers in the M&A process. This white paper focuses on the Integration Planning and Execution phases of the M&A process and how to approach these phases to ensure the best possible results.

The typical Mergers & Acquisitions process involves the following major phases –

-

Search and target identification

-

Preliminary due diligence and LOI

-

Detailed due diligence, offer, negotiation, and close

-

Integration Planning

-

Integration Execution

-

Measurement and Continuous Improvement

Our focus in this white paper is on phases 4 and 5 of mergers & acquisitions – Integration Planning and Integration Execution. While industry segment and location influence the scope and level of focus on certain activities within these phases, the phases themselves are universal and have some core activities irrespective of industry or geographical footprint. I will touch on some of the special considerations that multinationals need to address based on the geographical footprint of both the acquirer and the acquired entity.

We are also assuming here that no corners were cut in the detailed due diligence phase and that all the relevant information is available to the integration team. Many mergers & acquisitions fail to deliver on their promise as a result of poor due diligence.

There are two things to consider when planning an integration.

First – it is not a side activity that can be off-loaded on an unsuspecting executive. and

Secondly – the integration needs to be achieved quickly without significantly disrupting the operations of either entity while ensuring that the business case for the merger is not compromised.

The above considerations underscore the need to have a dedicated team (team size will vary based on the size and complexity of the integration). There is a lot of pressure to accelerate the realization of the planned integration benefits which results in companies taking on too much. For example, trying to optimize staffing while going through the integration process.

Management must recognize that there is an inherent level of inefficiency resulting in additional personnel costs till the integration is substantially completed. Forcing the issue – creates employee stress, mistakes, and unplanned employee departures which can further exacerbate the situation.

The first step is to establish an Integration Management Office (IMO), not unlike a Project Management Office (PMO), that is led by an executive that has respect and influence within the new C-Suite.

The primary role of the Integration Management Office (IMO) is Governance and Leadership of the integration effort

Here are some of the key activities of the group –

- Establish and communicate success metrics based on the business case.

- Establish and staff the Integration Management Office (IMO).

- Develop and publish an Integration Top-Map with the overall schedule, dependencies, and major milestones.

- Identify work-streams, develop work-stream charters, and identify a lead and sponsor for each workstream.

- Establish a mechanism for tracking, reporting progress, vetting, communicating key decisions, and resolving issues and conflict. There will be plenty of issues and conflicts during the integration. Having a well-articulated and consistent approach to addressing them will keep the program from being bogged down or going off track.

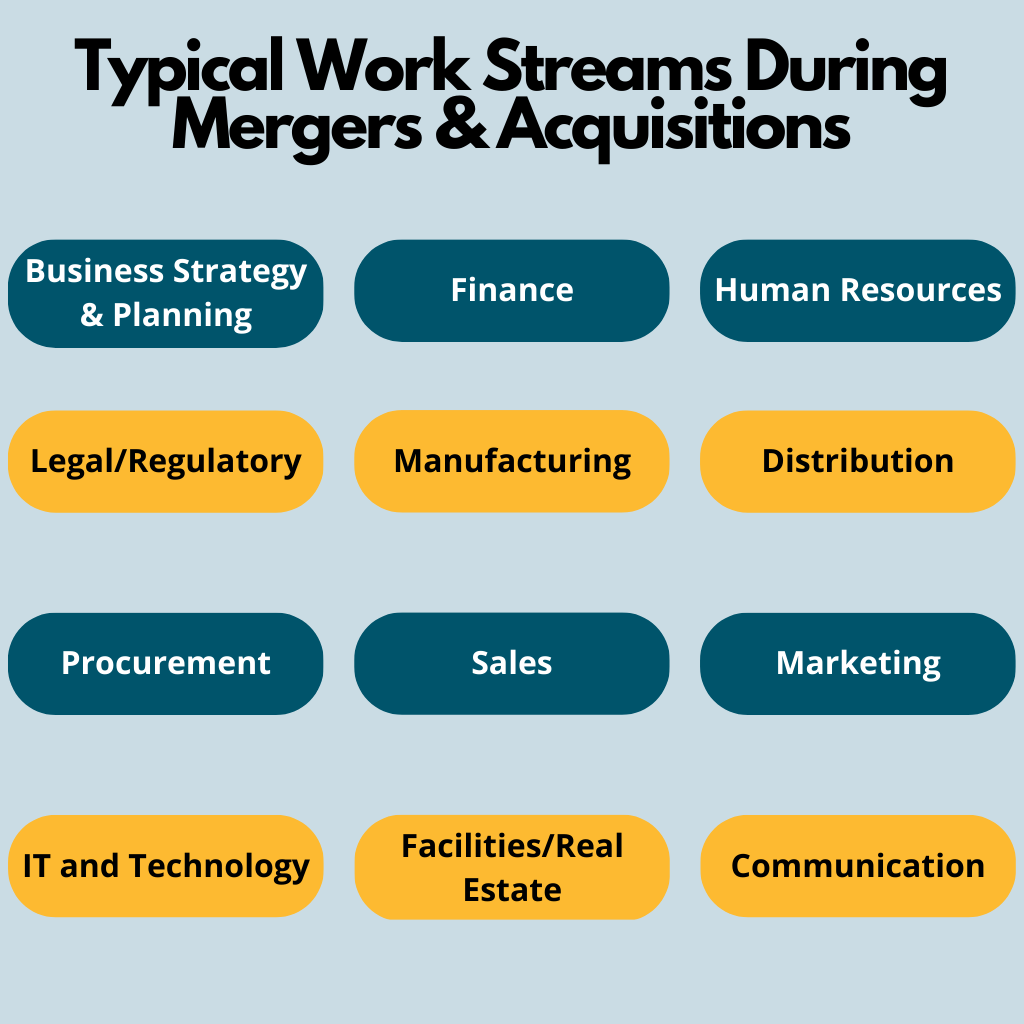

Typical Work Streams during Mergers & Acquisitions

- Business Strategy & Planning

- Finance

- Human Resources

- Legal/Regulatory

- Manufacturing

- Distribution

- Procurement

- Sales

- Marketing

- Technology

- Facilities/Real Estate

- Communication

It is important to recognize that while work gets organized into workstreams, most activities and decisions have cross-workstream dependencies and implications. For example, while HR handles all people moves – decisions regarding new roles/responsibilities, staff additions, RIFs, and such, are made jointly with the workstream that a given employee group is part of, for instance, Manufacturing or Finance.

Similarly, the Real-Estate workstream will pull together data on all the facilities, while impacted groups like Manufacturing will decide plant and warehouse consolidations and/or eliminations, and the real estate workstream will execute the changes – buying out leases or sub-letting facilities; coordinating build outs of facility expansions; facilitating moves etc.

In addition to the above typical workstreams, multinationals may have country and/or region-specific advisory teams that provide insight into local regulations, cultural sensitivities with respect to products and/or market messaging and such.

Larger mergers may also have additional hurdles to address prior to deal approval and closing

For example, they may need regulatory approval in each country they operate if there are concerns about the merger reducing competition or impacting national security. These types of approvals can take a long time and may involve litigation. They can also result in conditional approvals that require either guarantees or divestiture of certain operations or lines of business.

The recent Sprint – T-Mobile merger is an example.

There are multiple Mergers & Acquisitions scenarios that each dictate a different approach to integration

- A larger, more established company acquires a smaller player – In this scenario, the smaller entity is typically tucked into the larger entity either as a division or line of business or completely subsumed. In most cases, the smaller entity then migrates to the larger entity’s systems and adopts its policies. The acquisition of RedHat by IBM and the acquisition of LinkedIn by Microsoft are examples.

- A merger of equals – In this scenario, nearly everything gets negotiated – the organizational structure, who gets what roles, whose systems to adopt, whose policies to adopt, whose branding to adopt and such, or to jointly develop new ones to reflect the amalgamation of ideas from both sides. This type of merger is the most challenging to effect. Decisions are hard to come by making it difficult to estimate the integration cost and timeframe. The DOW – Dupont merger is an example.

- A platform rollup – Typically done by a Private Equity firm or other such investor. They start with one entity that they standardize first – standard policies, procedures, systems etc. Then they serially acquire entities and integrate them into the platform with a view to creating a larger, optimized entity that they can sell. The decision making is typically swift in this scenario. However, the pace of the integration is fast and there are typically a lot of rationalization of facilities and people.

Below is a sample checklist of the most common items each of the work streams must address during mergers & acquisitions

Finance Department

- Assume bank account control & signing authority

- Develop future state Legal Entity Structure

- Rationalize/Consolidate Bank Accounts

- Develop future state Charts of Accounts

- Develop future state Cost Center Structure

- Consolidate assets, rationalize depreciation schedules

Human Resources Department

- Future State Organizational Design & Professional Development

- Develop Organizational Structure/Target Span/Job Grading (Principles).

- Work with functional leaders to develop future-state functional organization

structure. - Develop performance measures & feedback process.

- Implement performance measurement process.

- Consolidate personnel needs from line organizations and develop a consolidated

RIF plan where needed.

- Develop & Deploy Future State Policies

- Develop and communicate updated Mission, Vision, Core Values

- Review and update information security policy

- Review and update employee handbook

- Develop & Deploy Future State Compensation & Benefits Plans

- Review and update Benefits Plan

- Develop Incentive Plans

- Plan Enrollment

- Establish & Implement Future State Expense Policy

- Executive

- Sales

- All Other

- Consolidate and Implement Employment Engagement Program

- Rewards and Recognition

- HR-Payroll Platform

-

- Select HR-Payroll platform

- Develop migration plan to new platform

- Execute HR-Payroll platform migration

-

Legal/Regulatory Department

- Consolidate and Review Contracts

- Customer Contracts

- Vendor Contracts

- JV and Other Partner Contracts

- Employment Contracts

- Ensure that all contracts are current and a fully executed copy is on file

- Review Customer, Vendor, and Employee disputes that require legal intervention or a

legal opinion. - Review and engage in any pending and on-going litigation.

- Formally notify Customers, Vendors, and Partners of Contract Assignment.

- Create Future Contract Templates and update protocols for use.

Manufacturing Work Stream

- Assess current manufacturing operations and develop a consolidated manufacturing

strategy - Update manufacturing operations based on strategy

- Tolling and outside processing

- Plant Maintenance strategy and plans

- Product costing approach

- Shop floor execution and reporting

Operations Department

- Review and update distribution and logistics strategy

- Review distribution network (warehouses, DCs) and update

- Expansions

- Divestitures/Closures

- Plan and execute movement of inventory

- Update transportation plans including any in-house fleets

- Customer Service

- Contact Centers

- Call volumes and other relevant contact center metrics

- SLAs if any and performance against SLAs over time

- Staffing level, skill mix

- Service Management

- Service Engineers

- Service Vehicles

- Inventories

- Scheduling

- Work Order creation, execution, and reporting

Sales Department

- Develop a consolidated sales strategy

- Consolidate and rationalize sales team, channels, and territories

- Review and standardize quotas and sales compensation

Marketing Department

- M&A – Proper Planning & Execution is Key to Delivering Shareholder Value

- Update Branding

- Consolidate and update website(s) and social media presence

- Integrate corporate communications teams, channels, and assets

Procurement Department

- Sourcing Strategy

- Complete a vendor evaluation and develop checklist of vendor relationships to

maintain/add and ones to exit - Consolidate vendor agreements and renegotiate vendor discounts, rebates, and terms

- Review and update blanket Point-Of-Sale System (POS)

- Execute updated vendor agreements

IT and Technology Work Stream

- IT Data Gathering

- Develop an application inventory, including details – (SaaS or On-Prem; Version;

Platform…) - Develop an infrastructure inventory, including data centers, co-los, data-closets,

equipment, versions, … - Develop an inventory of data stores, analytics, and reporting tools, and standard

analysis/reports provided - Inventory of IT Personnel including role, tenure, skillset, certifications, …

- Develop consolidated view of IT costs including Labor (both perm and contract);

Equipment, Software, Telecommunication, Service Contracts broken down by

capital and expense. Included additional budgeted spend. - List of all open IT projects/initiatives, schedule/budget; status; outstanding

spend (capital and expense).

- Develop an application inventory, including details – (SaaS or On-Prem; Version;

- IT Strategy

- Develop a business needs assessment for the consolidated business including a

listing of capability gaps. - Develop an updated, business needs aligned IT strategy and associated tactical

implementation plans. - Review implementation plans, sequencing, associated staffing, costs, and

timeline with management and gain approval.

- Develop a business needs assessment for the consolidated business including a

- Infrastructure Phase I

- Create consolidated active directory

- Phone System Integration

- Review site connectivity and create updated SD-Wan/MPLS plan

- Email Integration

- Desktop Services Approach; If outsourced, consolidate contracts and update

protocols, information security and desktop image standards - Select and Implement Conference Calling Vendor

- Consolidate Intranet Portal & Enterprise Level 1 Help Desk

- Infrastructure Phase II

- Develop Future-State Infrastructure Needs Assessment & Cost Estimate

- Review/Renegotiate Third-Party Hosting Contracts

- Develop Future-State Software License Needs & Cost Estimate

- Review/Renegotiate Third-Party Software License Contracts

- Review/Update Information Security Policies & Procedures

- Execute Roadmap

- Setup PMO and execute approved IT Roadmap. Recognize that this is not just an

IT exercise. The roadmap implementation must include implementation of

standard business processes and policies as well as data architectures, and the

associated responsibilities for data creation and maintenance.

- Setup PMO and execute approved IT Roadmap. Recognize that this is not just an

- IT Personnel

- Assess current and future state IT personnel needs

- Map current personnel to roles and determine personnel that need to be

retained and any required RIF - Evaluate all third-party Development/Support/Maintenance Contracts

- Develop retention plan for key IT resources to be retained

Facilities/Real Estate

- Develop inventory of all real-estate holdings (both owned and leased).

- Collect and review all leases, as well as cleaning, landscaping, and maintenance

contracts. - Provide the above details to both Finance and the relevant line organization (e.g. Manufacturing).

Communication Work Stream

- Develop & Implement Communications Plan

- Identify Key Stakeholders/Audiences, including vendors, customers, prospective

customers, shareholders, and other outside entities. - Develop a detailed communications plan, with content, timing, vehicles,

responsibilities. - Implement communications plan.

- Periodically audit the effectiveness of communications and adjust as needed.

- Identify Key Stakeholders/Audiences, including vendors, customers, prospective

The above categories and lists are not meant to be exhaustive but to provide both a sense of the scope of the typical post-merger integration effort and an outline for planning the integration project.

As with all such projects, the devil is invariably in the detail. Most companies do not have in-house expertise to plan and execute all aspects of a merger. Engaging third-party experts with specific M&A expertise can help companies avoid pitfalls and position themselves for the best possible outcome.

The key takeaways to deliver shareholder value during mergers & acquisitions are

- Post-merger integration is a complex exercise that requires proper planning, funding, and governance.

- Staffing the effort can be a challenge. It requires careful planning and sourcing. Expecting folks with full-time jobs to work on significant integration tasks is not realistic.

- Change management is key to ensure alignment and adoption and limiting frustration and staff turnover.

About the Author

Sukumar Narayanan is President of DecisivEdge, a global business consulting and technology services firm focused on creating a sustainable competitive edge through digital transformations.

Sukumar has more than 15 years of experience leading large, global professional services firms focused on both consulting services as well as managed services. He also has over 30 years of experience as a consultant with expertise in IT strategy and in leading corporations through large technology-enabled business transformation programs in the United States, the United Kingdom, Europe, Asia and the Middle East.

At DecisivEdge, Sukumar is responsible for business development, practice development and delivering consulting services for Mergers & Acquisitions to select customers.