Loan Servicing Software

Lease and loan servicing software, powered by Oracle, customized for your unique lending business by DecisivEdge.

A Lease and Loan Servicing Software That's

Built for How You Lend.

The way you service loans and leases is unique – and your software should reflect that. Yet many financial institutions are still relying on legacy systems that weren’t designed for today’s complex servicing demands. With DecisivEdge and OFSLL – you’re reimagining how servicing gets done.

From account setup and payment processing to delinquencies, renewals, and end-of-term actions, our loan servicing software is purpose-built to support your servicing workflows.

The result? Faster operations, fewer errors, lower risk, and a better borrower experience from start to finish. Automate key tasks with loan servicing software like payment processing, account maintenance, and customer service, streamlining operations and improving borrower satisfaction.

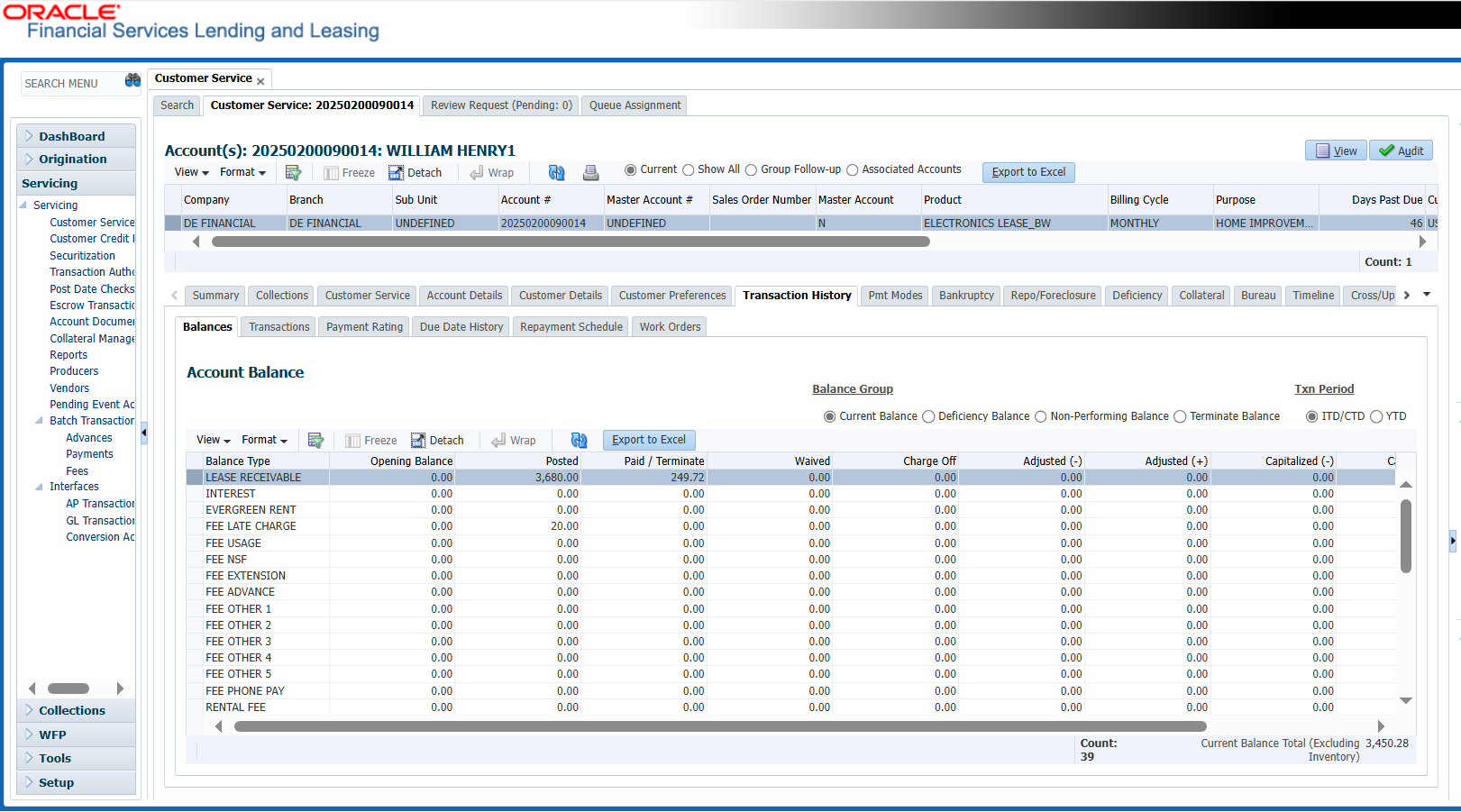

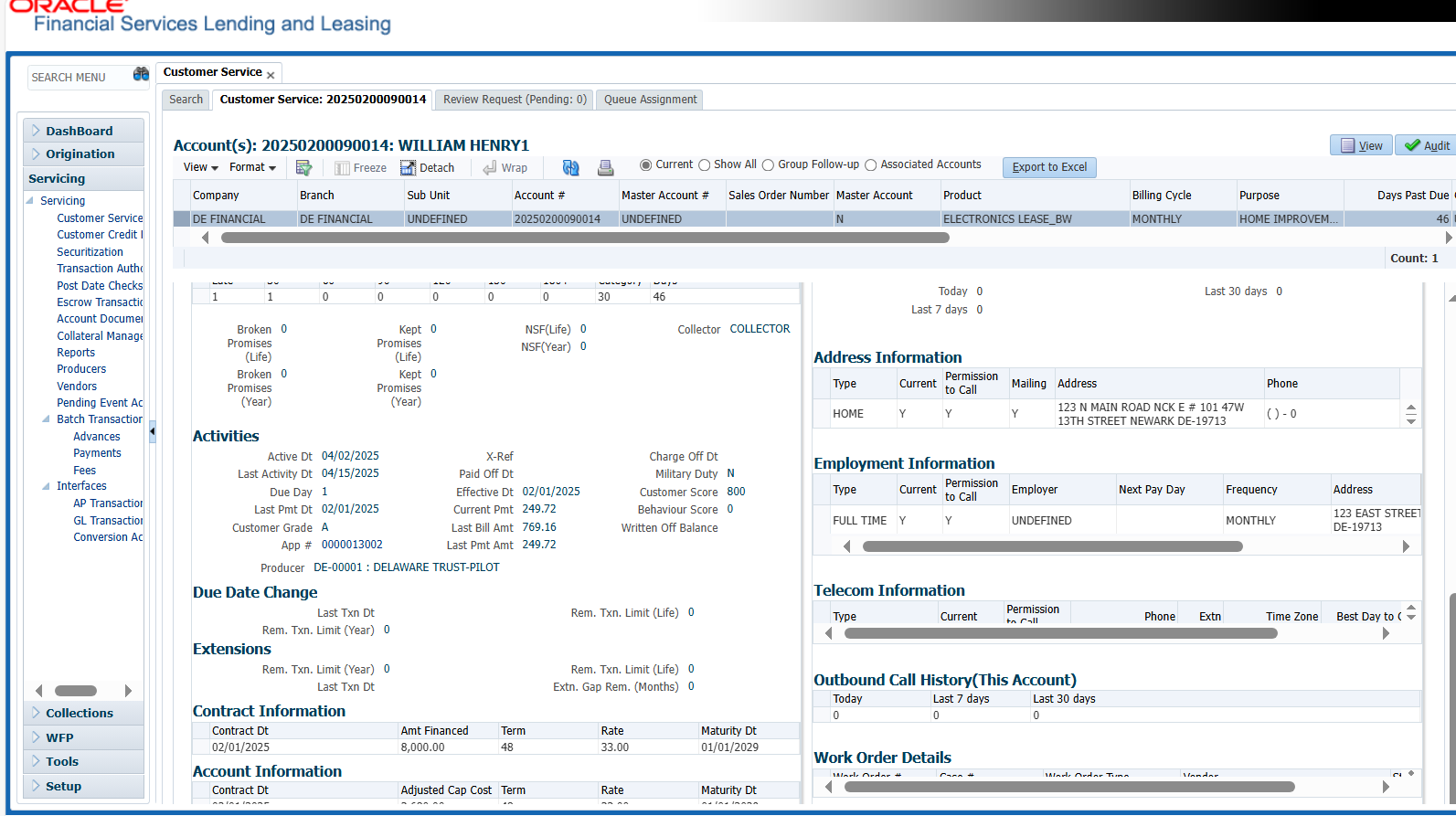

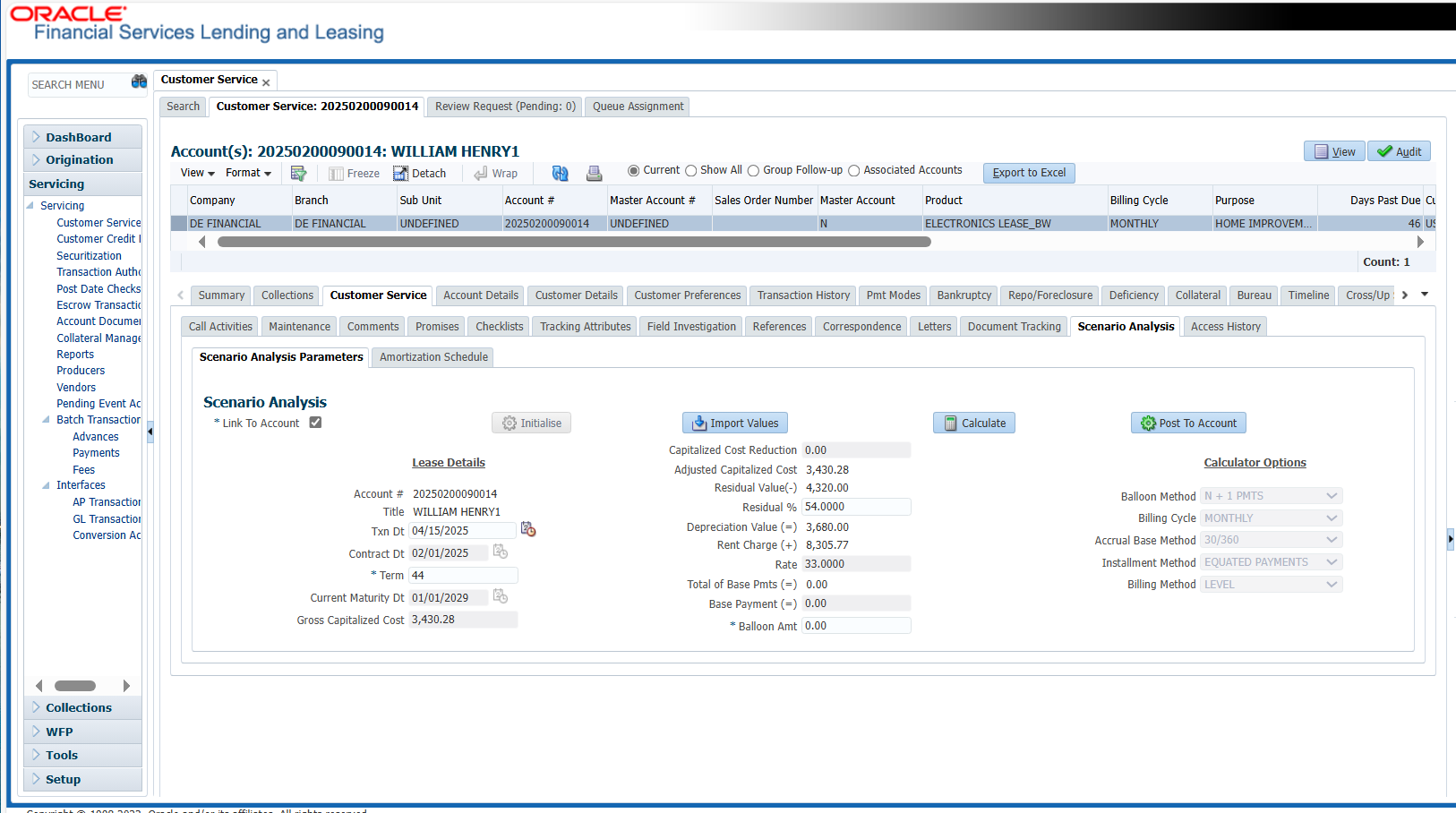

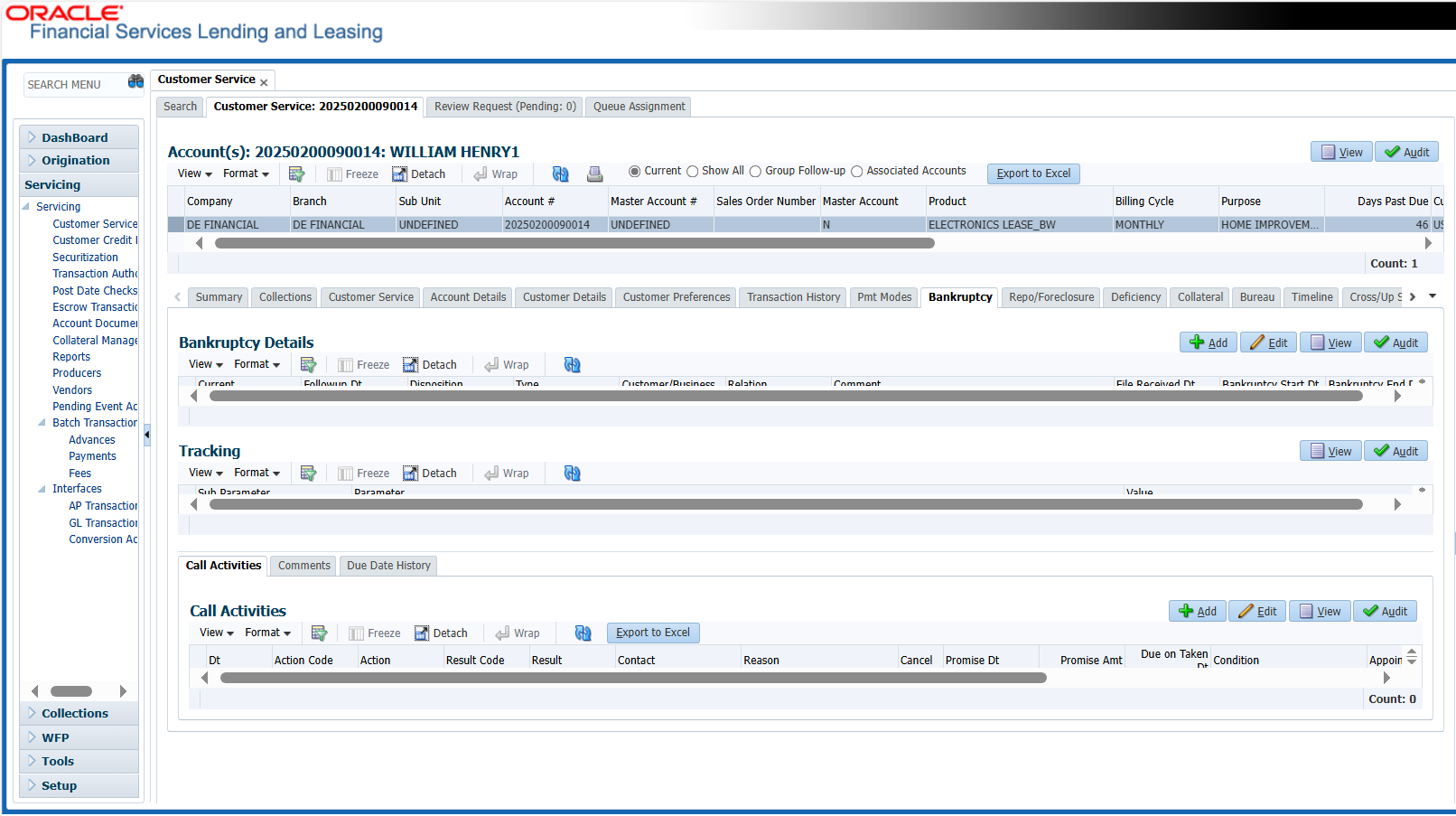

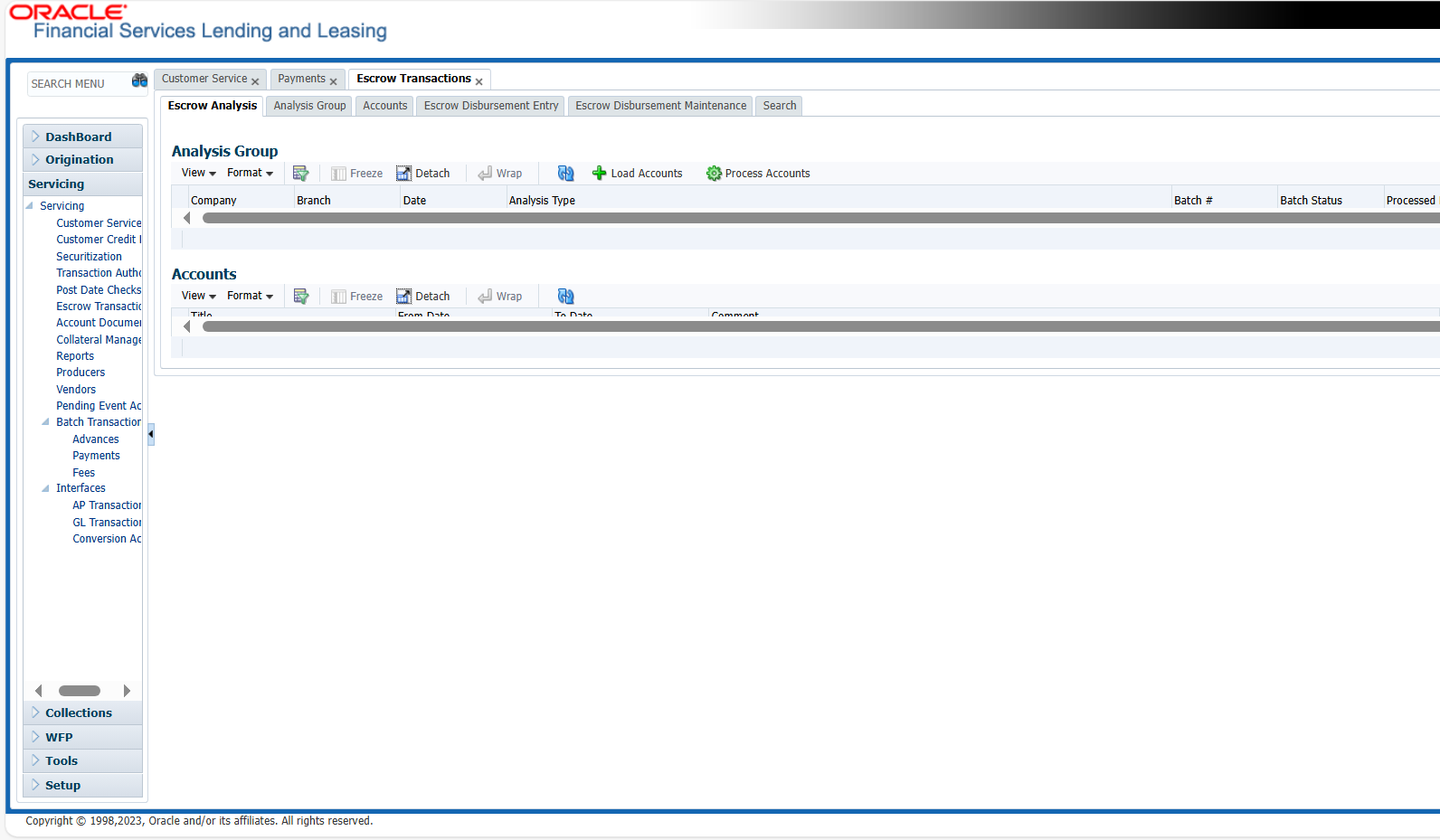

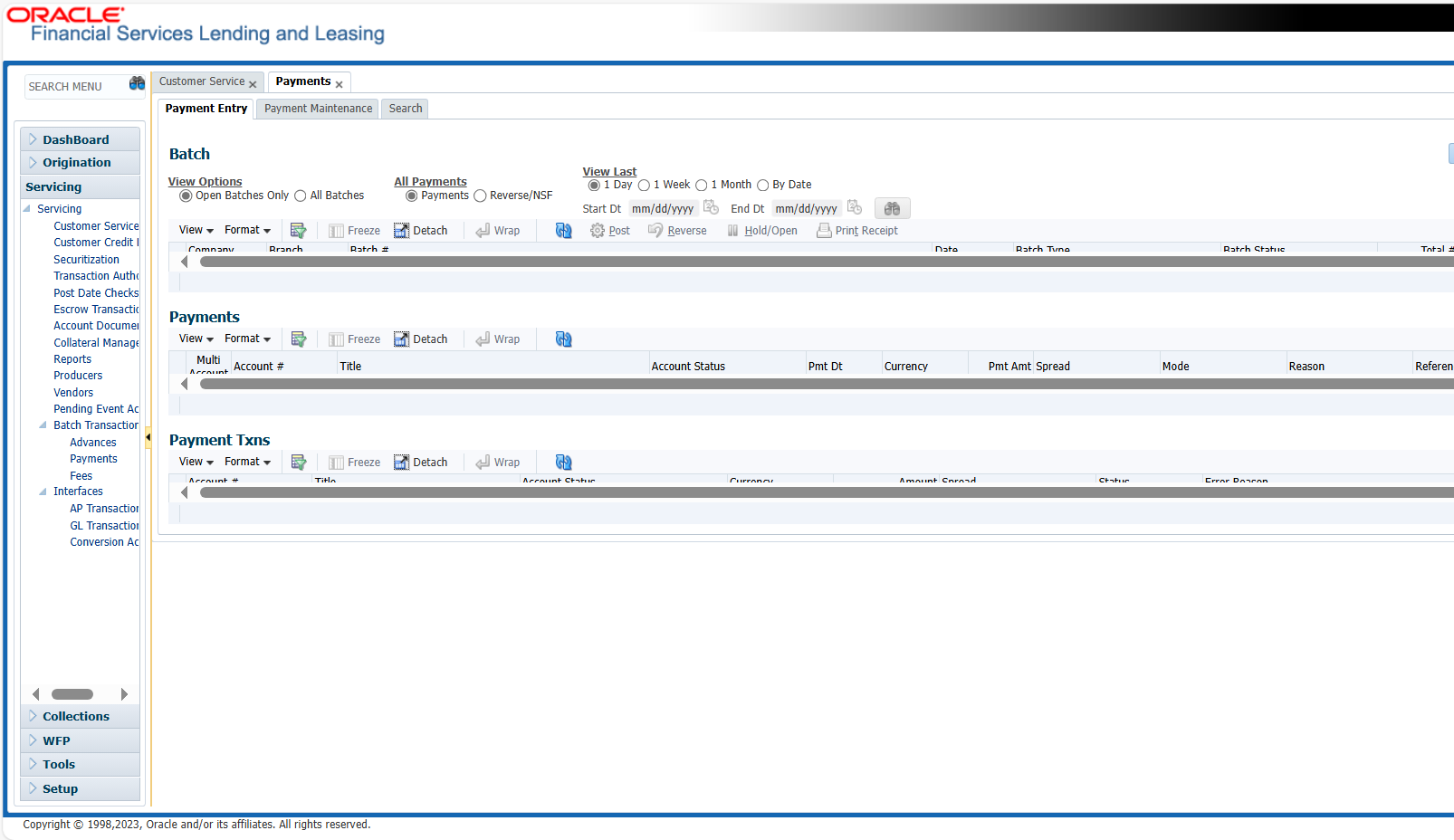

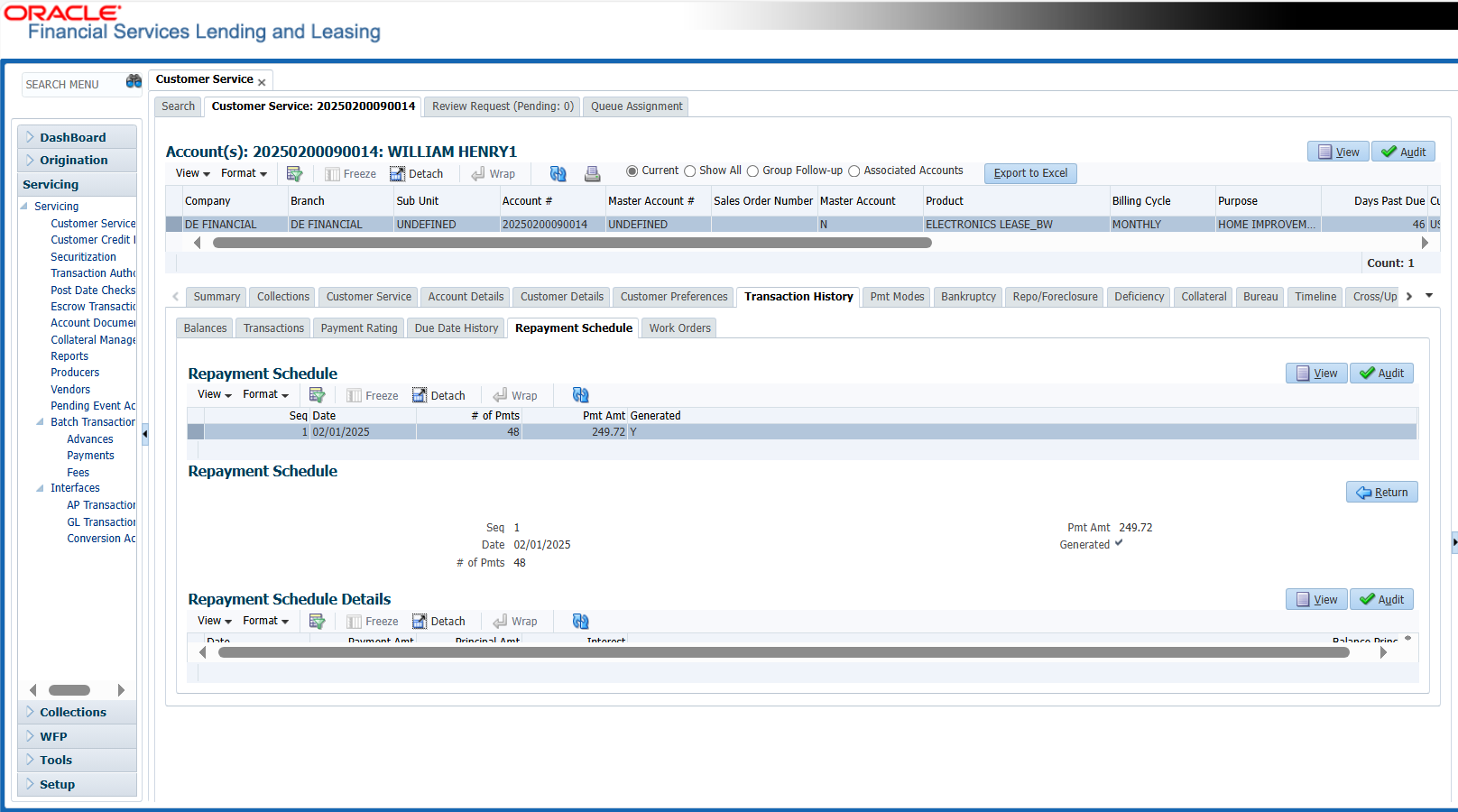

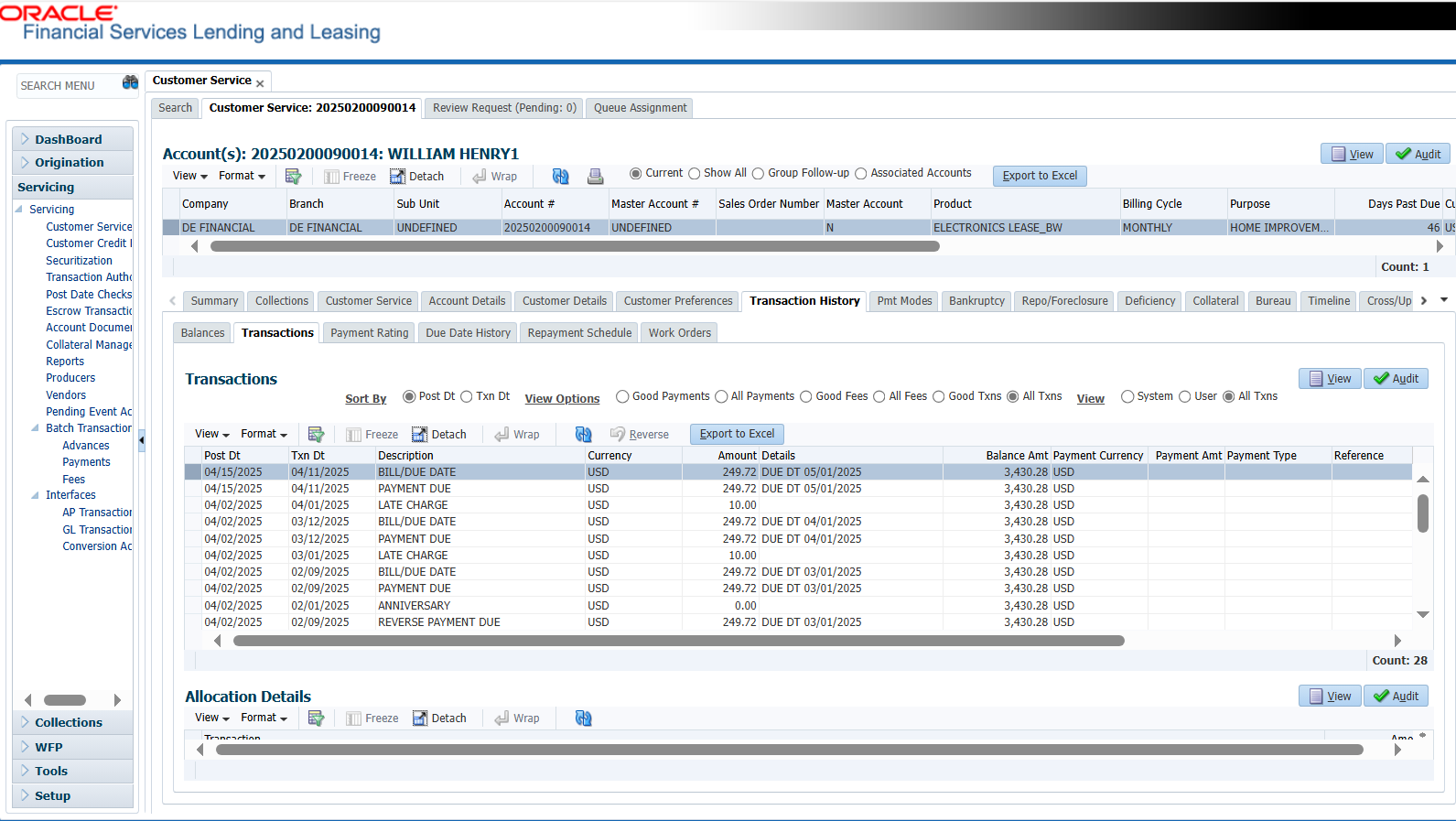

Get a Visual Tour of the OFSLL Lease and Loan Servicing Software

*Note: The visuals shown above use sample data for demonstration purposes.

Key Feature of Loan Servicing Software Module

| Feature of Loan Servicing Software | Why It Works |

| 1. Real-time account summary & balances | One-stop snapshot of the loan’s status |

| 2. Amortization & payment schedule view | Clearly shows payment dates, amounts, breakdown |

| 3. Transaction history & audit trail | Trust-building for clients—every action is logged |

| 4. Interest/principal breakdown & rate tracking | Shows variable/fixed interest rate, margin, etc. |

| 5. Escrow and insurance/tax tracking | Visualizes escrow flow, important for compliance |

DecisivEdge Addresses Your Loan Servicing Software Challenges by Offering

Automated Payment and Billing Schedules

We configure OFSLL loan servicing software module to manage recurring payments, amortization schedules, interest adjustments, and late fee calculations – automatically and accurately.

→ Outcome: Fewer missed payments, faster collections, and greater borrower satisfaction.

End-of-Term and Renewal Management

Whether you’re handling lease buyouts, term extensions, or auto-renewals, OFSLL loan servicing software simplifies complex servicing tasks and compliance requirements.

→ Outcome: Smooth end-of-term transitions with reduced manual intervention and error risk.

Real-Time Account Monitoring and Servicing Dashboards

Track delinquencies, payment histories, asset statuses, and servicing KPIs through intuitive dashboards and automated alerts.

→ Outcome: Immediate visibility into servicing health and quicker action on at-risk accounts.

Key Benefits of Our Customized

OFSLL Loan Servicing Software Solution:

Whether you’re managing auto loans, equipment leases, or consumer financing products, OFSLL supports the full servicing lifecycle – from the moment a contract is activated to its final closeout.

We configure the loan servicing platform to handle amortization schedules, recurring payments, asset tracking, insurance management, and end-of-term actions like buyouts or returns.

Result: A unified servicing platform reduces system switching, manual reconciliation, and process fragmentation—creating consistency across all accounts and servicing teams.

Servicing compliance goes beyond origination – it involves adhering to rules for payment processing, disclosures, asset repossession, customer communications, and tax handling across jurisdictions.

OFSLL’s servicing software built-in rule engine, automated audit trails, and digital documentation workflows help ensure ongoing servicing compliance without requiring manual oversight.

Result: Your organization stays audit-ready while reducing the risk of fines, missed deadlines, or non-compliant servicing activities—especially in high-volume or multi-state portfolios.

Manual servicing tasks like generating statements, recalculating balances, updating insurance records, applying fees, or initiating renewals can create major operational bottlenecks.

We automate these workflows in OFSLL Loan Servicing Software – ensuring tasks are triggered based on contract terms, borrower behavior, or business rules. We also integrate notifications and document generation to keep both staff and customers in the loop.

Result: Faster turnaround times, fewer servicing errors, and significantly reduced admin burden on your internal teams.

Generic reporting tools don’t offer the visibility that servicing teams need.

That’s why we configure OFSLL dashboards specifically for servicing roles – showing contract status, payment delinquencies, asset depreciation, lease maturity dates, and customer risk flags. Alerts can be set up for missed payments, contract violations, or pending renewals, so your team can act before issues escalate.

Result: You gain real-time control and insight over your servicing book, helping you proactively manage risk, improve response times, and protect portfolio health.

As your portfolio grows, servicing complexity increases – more assets to track, more contracts to manage, and higher expectations from borrowers and regulators. OFSLL is designed to support this growth.

Whether you service 500 or 500,000 contracts, the loan servicing platform handles multi-entity, multi-product, and multi-region operations with ease. We build in custom modules and scalable infrastructure to meet your growth needs.

Result: You won’t outgrow your servicing platform—OFSLL evolves with your business, so you can expand without replatforming or compromising on control.

Case Study: DecisivEdge Modernizes State-Based Student Lender’s Loan Servicing and Collections System

A prominent student lender, responsible for administering one of the largest state-based lending programs in the U.S., faced significant challenges from their legacy loan platform. The core software, written in COBOL and Assembler, was designed decades ago and, while it had served its purpose, it now faced substantial limitations.

DecisivEdge leveraged its extensive experience in lending and digital transformation to modernize the lender’s operations with a customized implementation OFSLL.

Their new solution is efficient and compliant, giving them the agility they need to adapt to ever-evolving landscape of college financing with new products, better and more timely communication with their borrowers while adhering to complex regulations and scrutiny by the CFPB.

Industry-Specific Solutions for Enhanced Lending Performance.

OFSLL's Integration Partners