Loan Collection Software

Lease and loan collection software, powered by Oracle, customized for your unique lending business, by DecisivEdge.

A Lease and Loan Collection Software That's

Built for How You Lend.

At DecisivEdge, we help lenders and lessors streamline their lease and loan collections processes using Oracle Financial Services Lending and Leasing (OFSLL). How? By fine-tuning OFSLL’s robust lease and loan collection software to fit your operations, compliance environment, and recovery goals.

So, whether you’re dealing with consumer loans, equipment leases, or BNPL (and more), we optimize your loan collection software to work harder, faster, and smarter for your team.

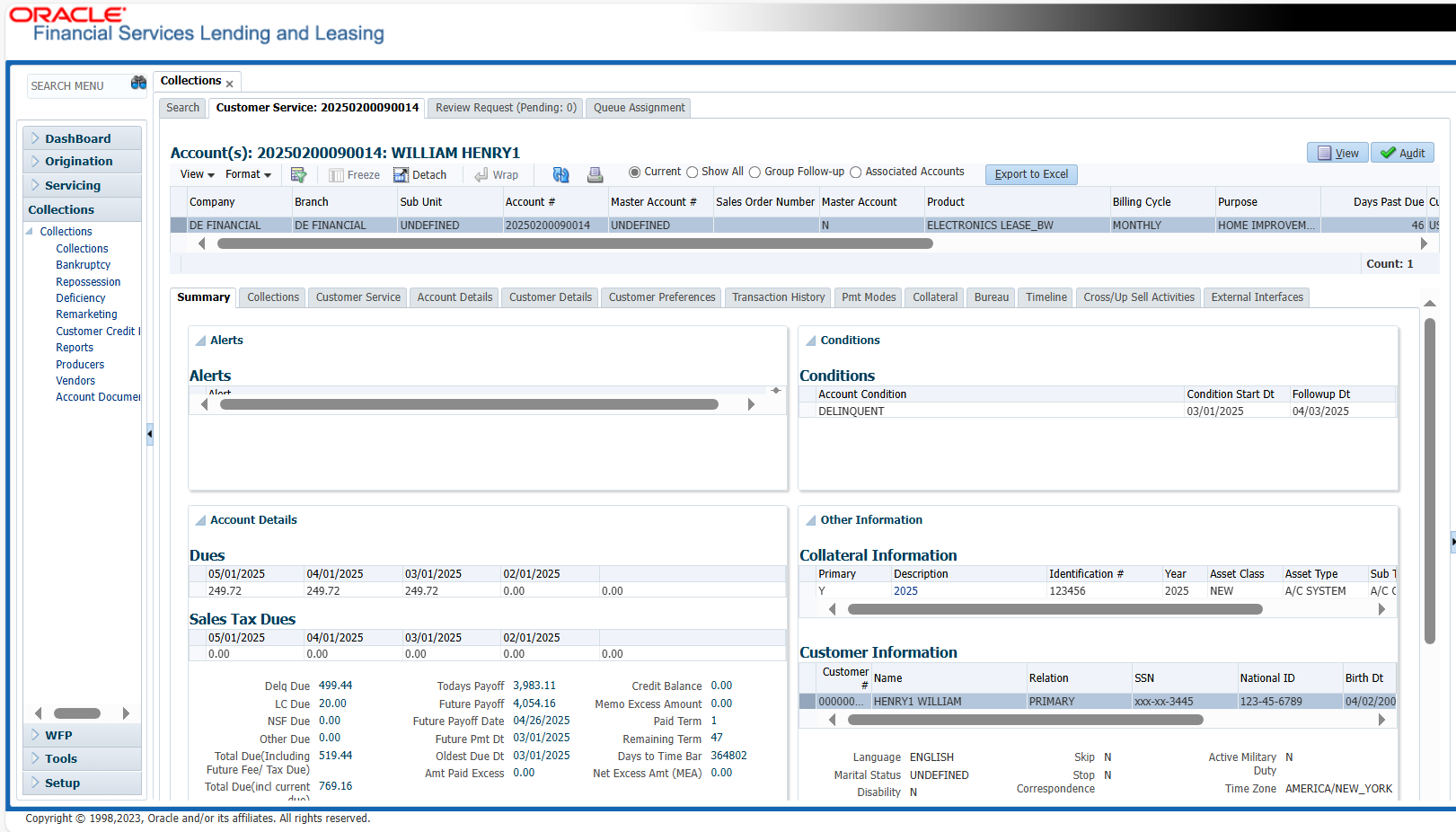

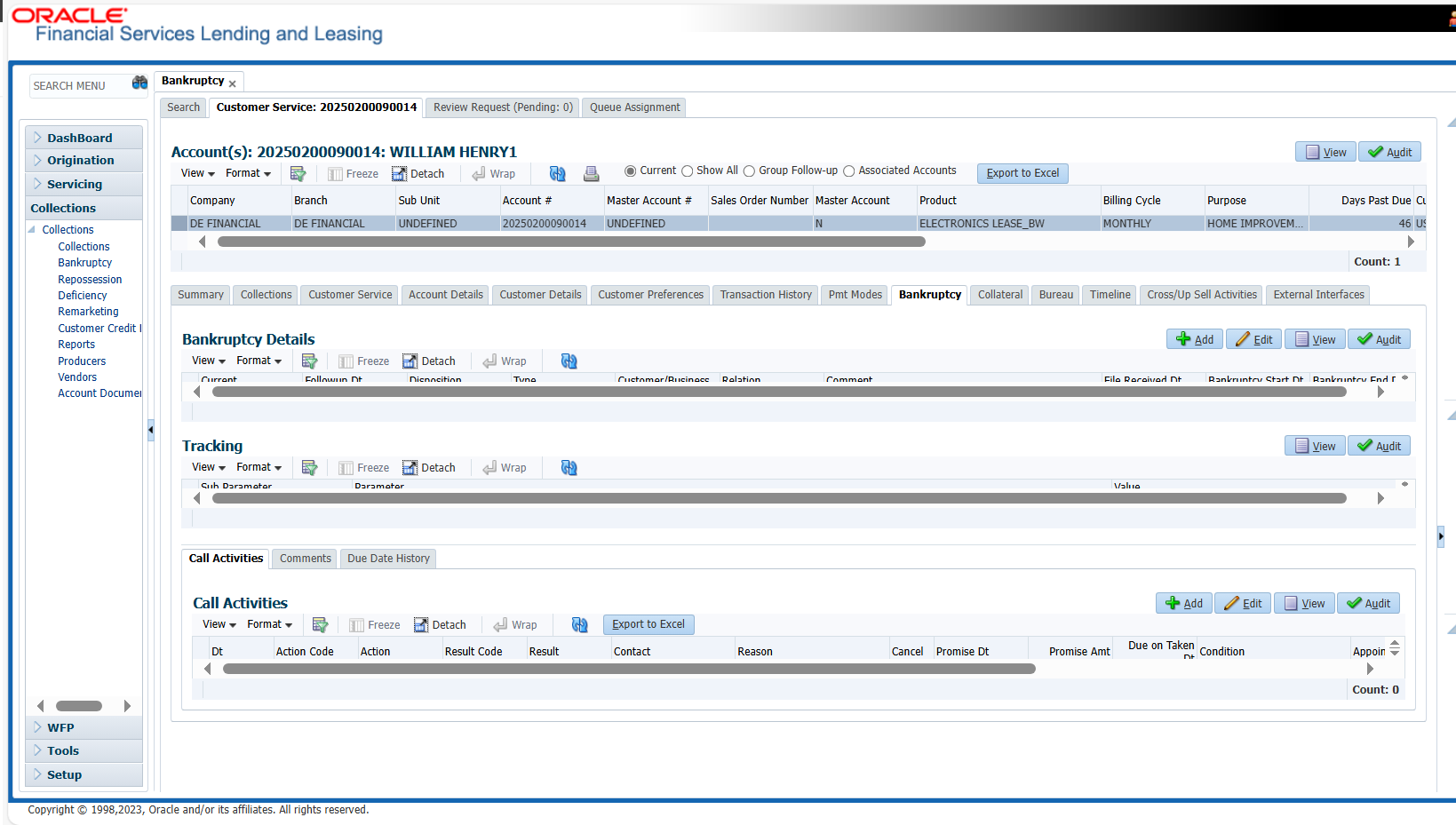

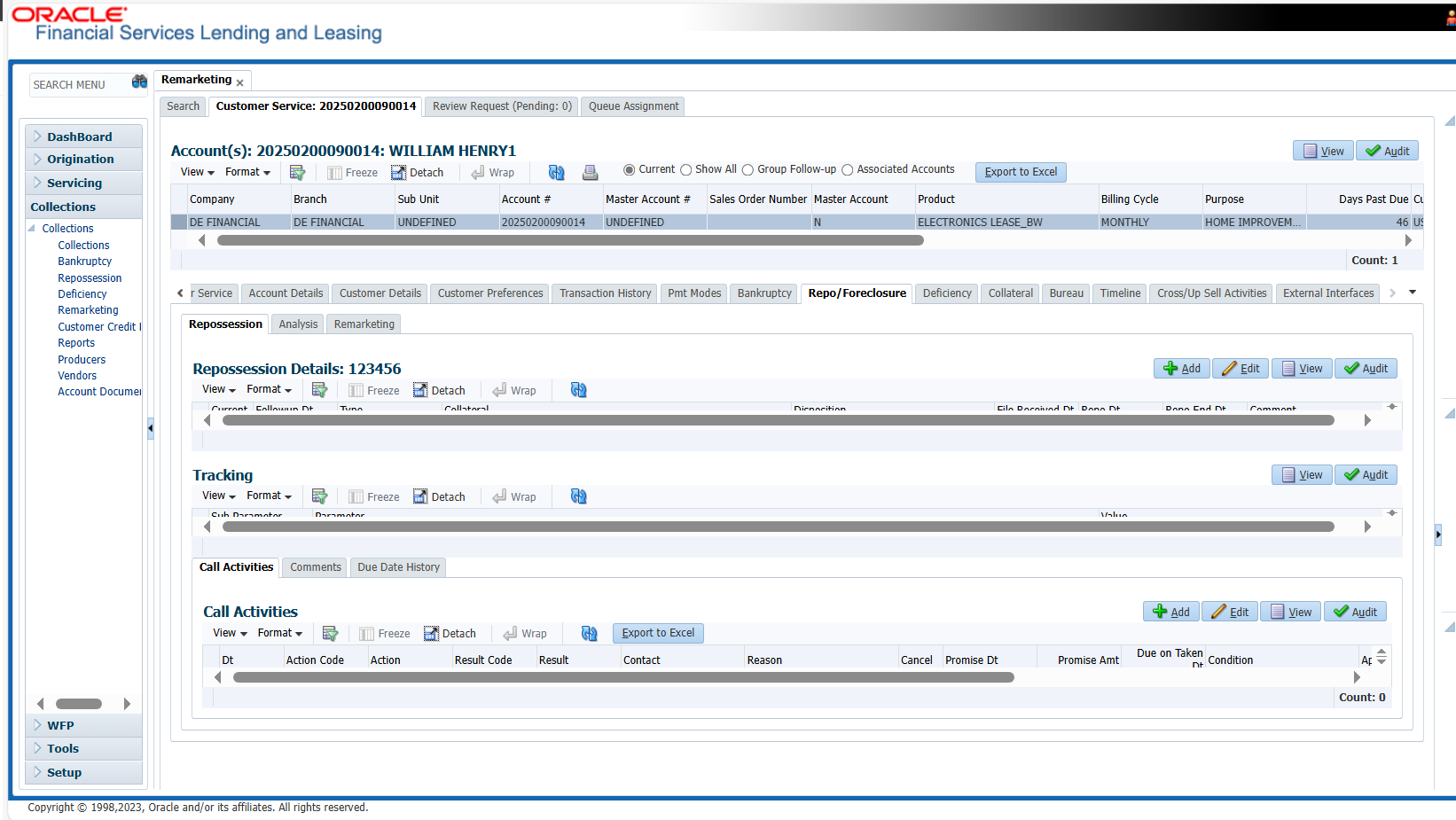

Get a Visual Tour of the OFSLL Lease and Loan Collection Software

*Note: The visuals shown above use sample data for demonstration purposes.

Key Features of OFSLL's Loan Collection Software Module

| Feature of Our Loan Collection Software | Why It Works |

| 1. Centralized collections dashboard | Gain real-time visibility into delinquent accounts, collector queues, recovery KPIs. |

| 2. Automated collections workflows | Reduces manual errors and ensures compliance by automating actions (calls, letters, legal steps) based on configurable rules. |

| 3. Promise-to-Pay and Broken Promise tracking | Track payment commitments and follow-ups, and help collections teams prioritize high-risk accounts. |

| 4. Integrates with servicing and accounting functions | Keep collector actions in sync with servicing activity and general ledger, reducing reconciliation errors. |

| 5. Collector performance monitoring | Get insights into individual and team-level effectiveness. |

| 6. Customizable communication templates | Speed up outreach while ensuring regulatory-compliant, personalized borrower engagement. |

| 7. Legal and repo workflow management | Track accounts through different means: litigation, repossession, and even recovery. |

How DecisivEdge Strengthens Your Loan Collections Strategy through OFSLL...

Seamless, Connected Workflows.

When collections, legal, and servicing teams operate in silos, delays and miscommunication are inevitable. We configure the loan collection software to ensure everyone is working from the same system, with shared visibility and coordinated next steps.

- Automate task assignments, case routing, and escalations across teams

- Centralize account updates and communication logs for full transparency

- Reduce turnaround times with real-time status tracking and alerts

Adaptive Recovery Strategies Based in Data.

Rigid, one-size-fits-all approaches don’t work in today’s collections environment. We enable dynamic, data-driven strategies that let you tailor outreach and actions based on each borrower’s risk and behavior.

- Segment accounts by risk profile, aging buckets, or borrower history

- Define flexible workflows based on triggers like missed promises-to-pay

- Automate next-best actions using rules, not guesswork

Compliance-First Operations = Efficient Operations.

Strong governance shouldn’t slow you down. Our enhanced loan collection software reduces manual effort, improve oversight, and help your team stay compliant.

- Build audit-ready documentation and timestamped action logs

- Automate compliant dunning and borrower notifications

- Streamline collector workloads through intelligent process automation

Key Benefits of Our Customized

OFSLL Loan Collection Software Solution.

Collections isn’t just about calling people who missed payments-it’s about knowing which accounts to focus on, when, and how. OFSLL’s loan collection software advanced segmentation and strategy automation improve outcomes across delinquency buckets. So, your team can automatically group borrowers based on how late they are, how likely they are to pay, and their payment history. Then, we set up smart rules to guide what happens next—whether it’s a reminder, a follow-up call, or a handoff to legal.

Result: Your team spends less time guessing and more time recovering overdue balances: leading to faster collections and fewer write-offs, especially from accounts that used to slip through the cracks.

In collections, timing and coordination are everything. We enhance OFSLL’s built-in workflows using rule-based automation and event-driven triggers. This ensures that follow-up actions like sending a reminder, assigning a collector, or escalating to legal – happen automatically, based on account status and timing.

Collectors get real-time dashboards that show where each account stands, what’s overdue, and what action is next, eliminating guesswork and delays.

Result: You reduce days sales outstanding (DSO), resolve delinquencies faster, and increase throughput—without relying on manual tracking or spreadsheets.

Capture a complete digital audit trail using system-generated logs, time-stamped events, and user action histories. This includes call attempts, payment arrangements, broken promises, and communication templates, where each is tied to a specific workflow and account.

You can also define business rules using loan collection software rule engine to enforce compliance with internal policies (e.g., wait periods between contacts) and external regulations (like FDCPA or UDAAP), reducing the risk of human error.

Result: Your organization is always audit-ready with transparent records, automated compliance checks, and built-in controls that help avoid regulatory penalties or failed reviews.

Manual intervention across the collections lifecycle drives up servicing costs and slows down recovery efforts. Leverage OFSLL’s workflow orchestration engine, batch processing, and event-based automation to eliminate repetitive tasks like status updates, contact scheduling, and case escalation.

Collectors operate through a single user interface integrated with servicing, legal, and accounting modules—reducing swivel-chair activity and duplicate data entry. Role-based queues and intelligent task prioritization further streamline daily operations.

Result: Operational costs drop as automation reduces dependency on manual processes. Your team handles more accounts per collector, increases throughput, and avoids costly delays in the collections cycle.

To manage collections effectively, you need real-time, actionable insights. We enhance OFSLL by building custom dashboards, role-based views, and KPI tracking tools that give collections managers visibility into everything they need to do their work more effectively.

Data is pulled from across the OFSLL platform (servicing, collections, legal, and accounting) and visualized using embedded reporting tools or integrated BI platforms. In other words, OFSLL helps give leaders better control over collections strategy and resource allocation.

Result: Your leadership team makes faster, data-backed decisions. Shift strategies, reallocat resources, and identify bottlenecks early to improve recovery outcomes.

Case Study: DecisivEdge Modernizes State Based Student Lender's Loan Servicing and Collections System

A national student lender needed to replace their outdated loan servicing and collections system, to one that was scalable and sustainable. The core software, written in COBOL and Assembler, was designed decades ago and, while it had served its purpose, it now faced substantial limitations: finite reporting and analytics, operational inefficiencies, maintenance challenges, and scalability issues.

The implementation of OFSLL enhanced with customizations provided by DecisivEdge, resulted in a modern and comprehensive loan servicing platform, freeing the student lender from manual workarounds.

Their new solution is efficient, and compliant giving them the agility they need to adapt to ever-evolving landscape of college financing with new products, better and more timely communication with their borrowers while adhering to complex regulations and scrutiny by the CFPB.

Industry-Specific Solutions for Enhanced Lending Performance.

OFSLL's Integration Partners