Loan Origination Software (LOS)

Lease and loan origination software, powered by Oracle, customized for your unique lending business by DecisivEdge.

A Lease and Loan Origination Software That's

Built for How You Lend.

In today’s fast-paced financial environment, efficiency, accuracy, and customer satisfaction are paramount.

But, many organizations are currently grappling with outdated systems that hinder growth and efficiency – including their lease and loan origination software.

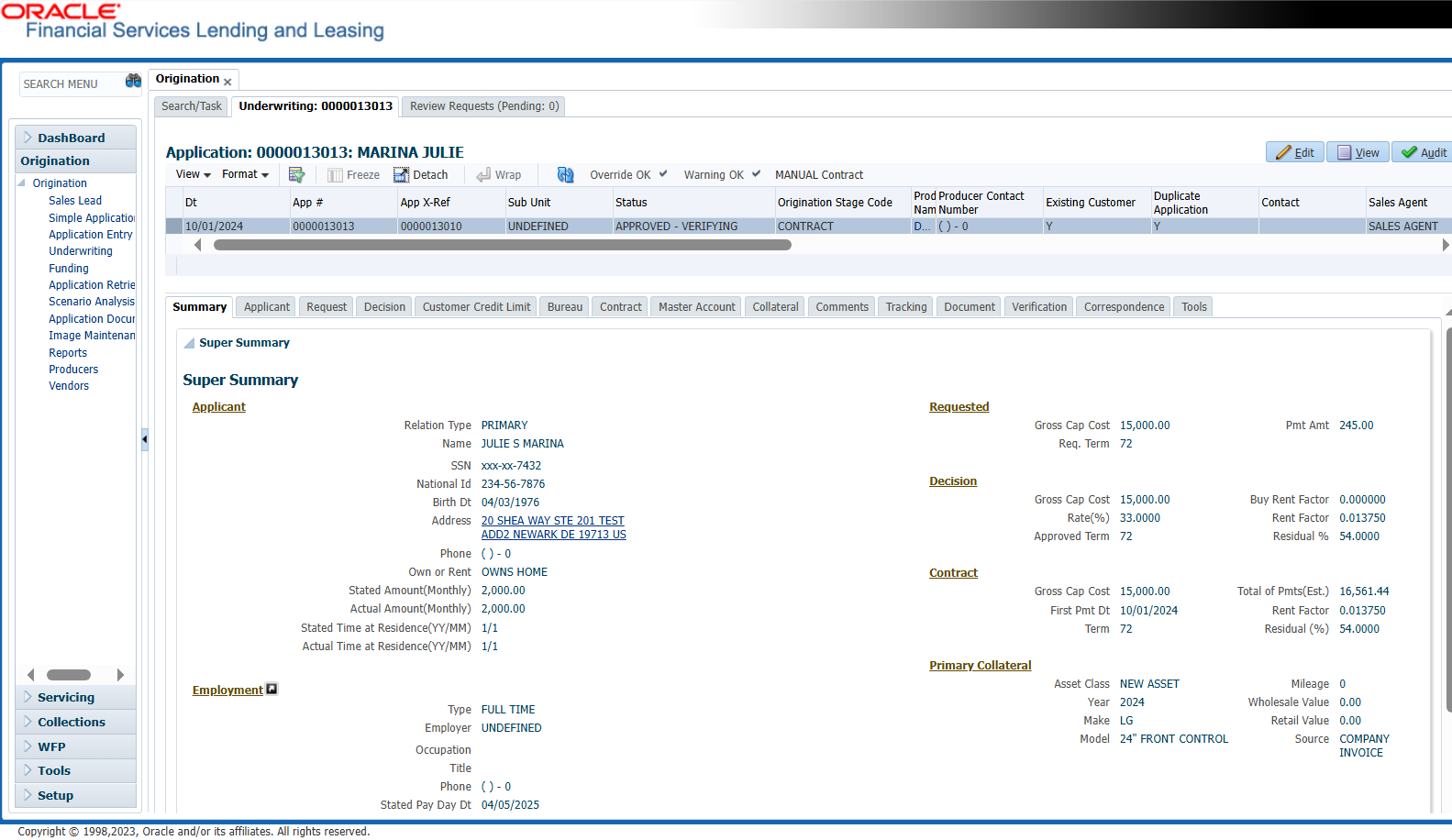

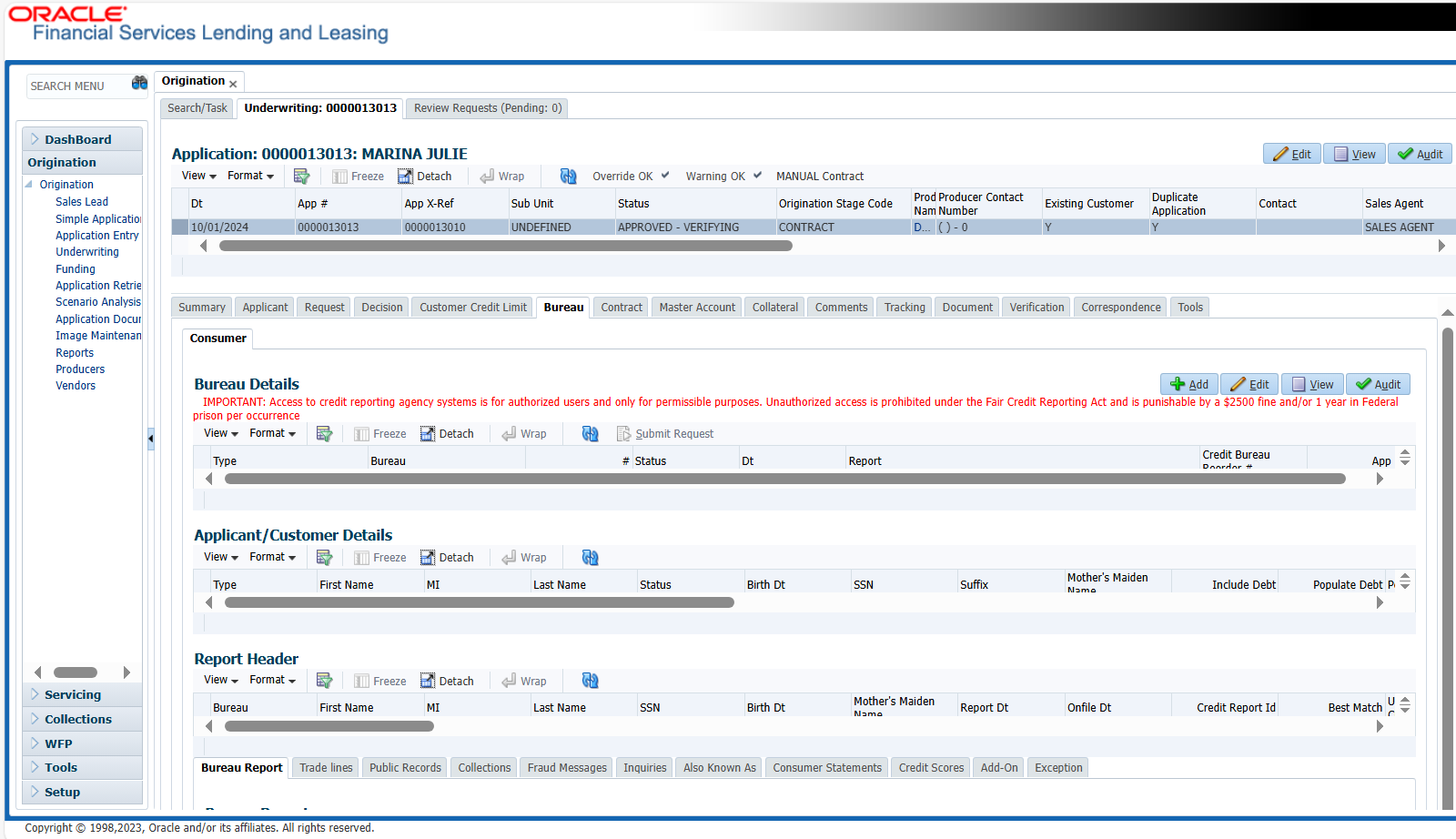

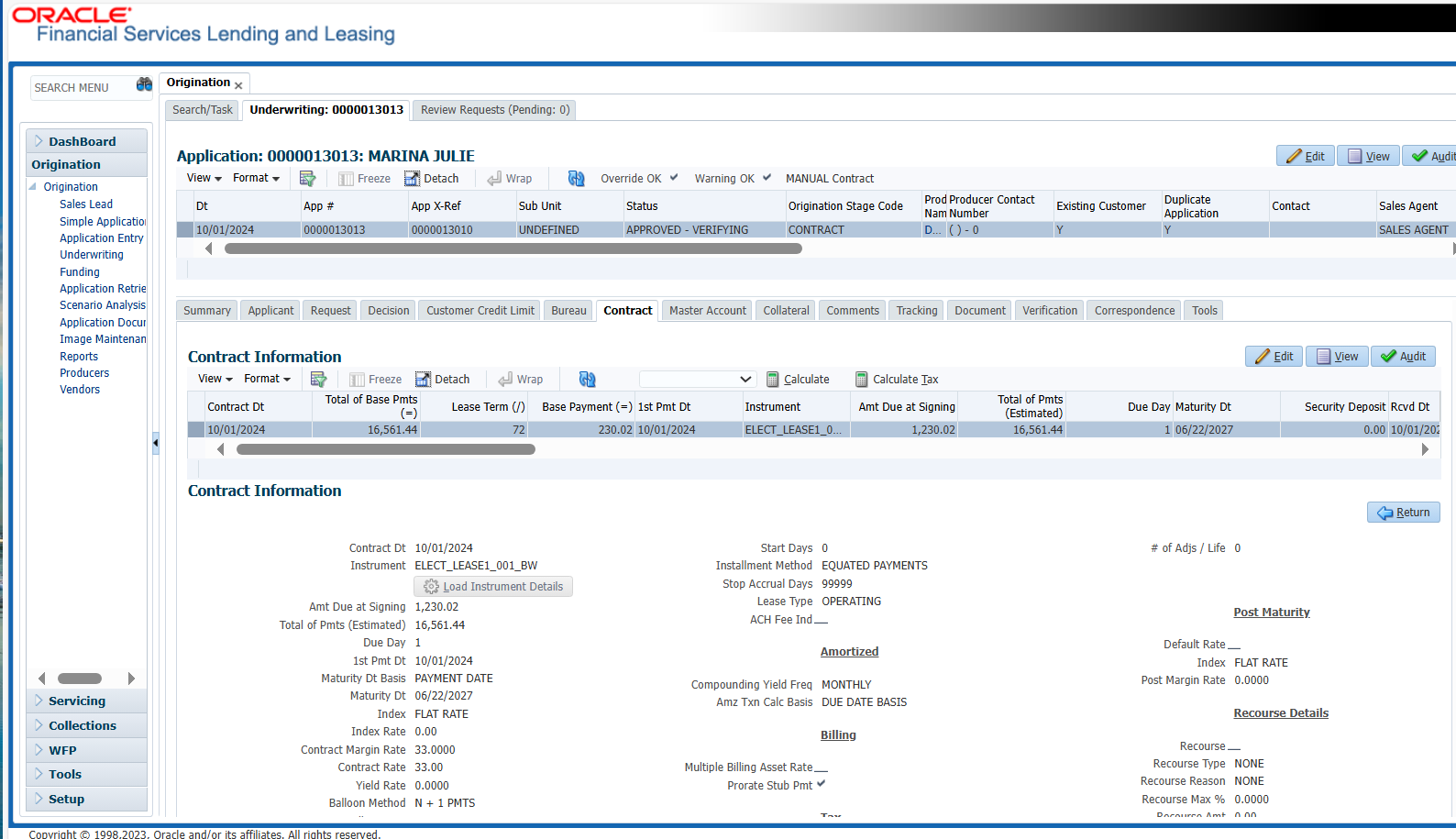

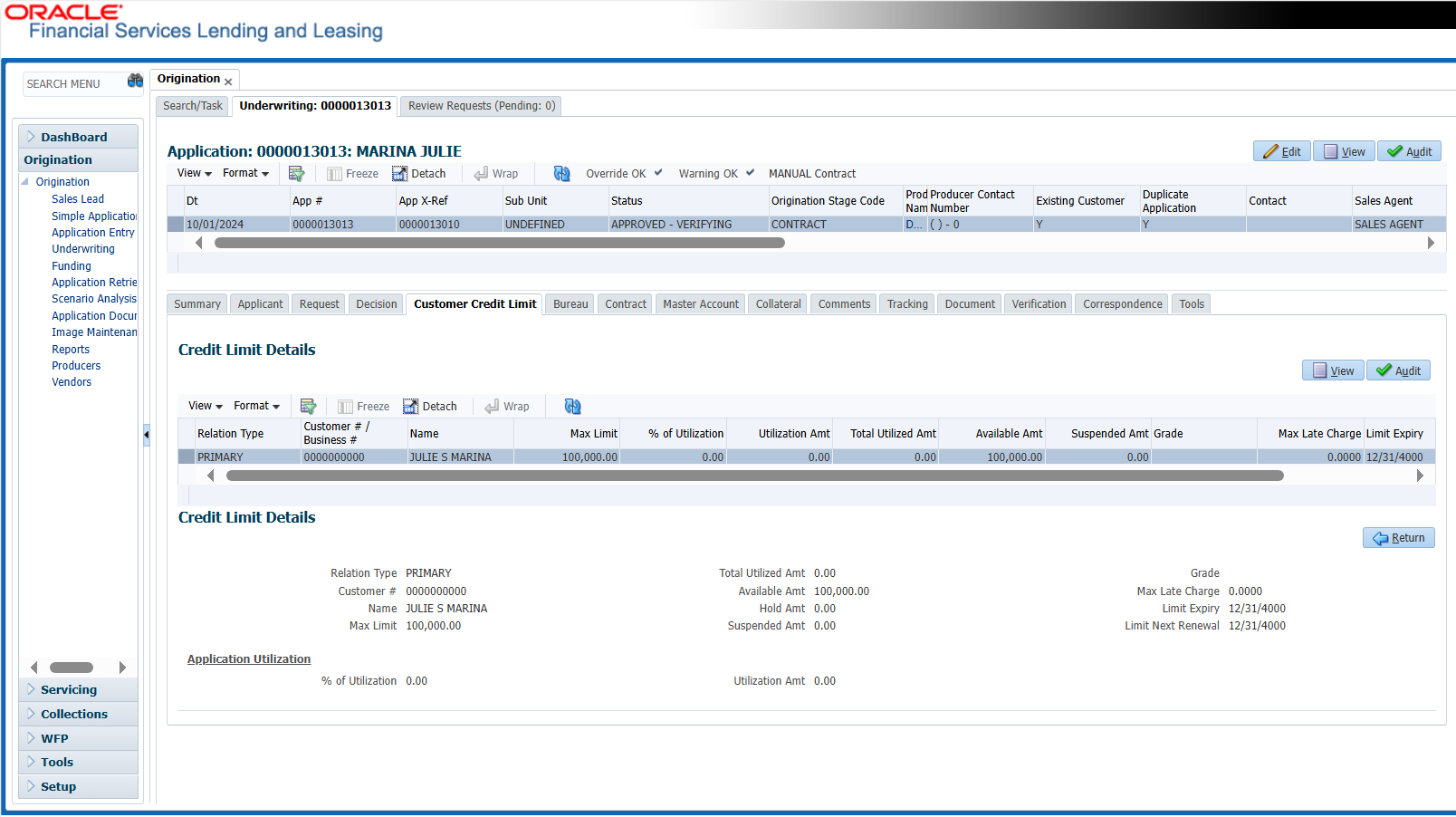

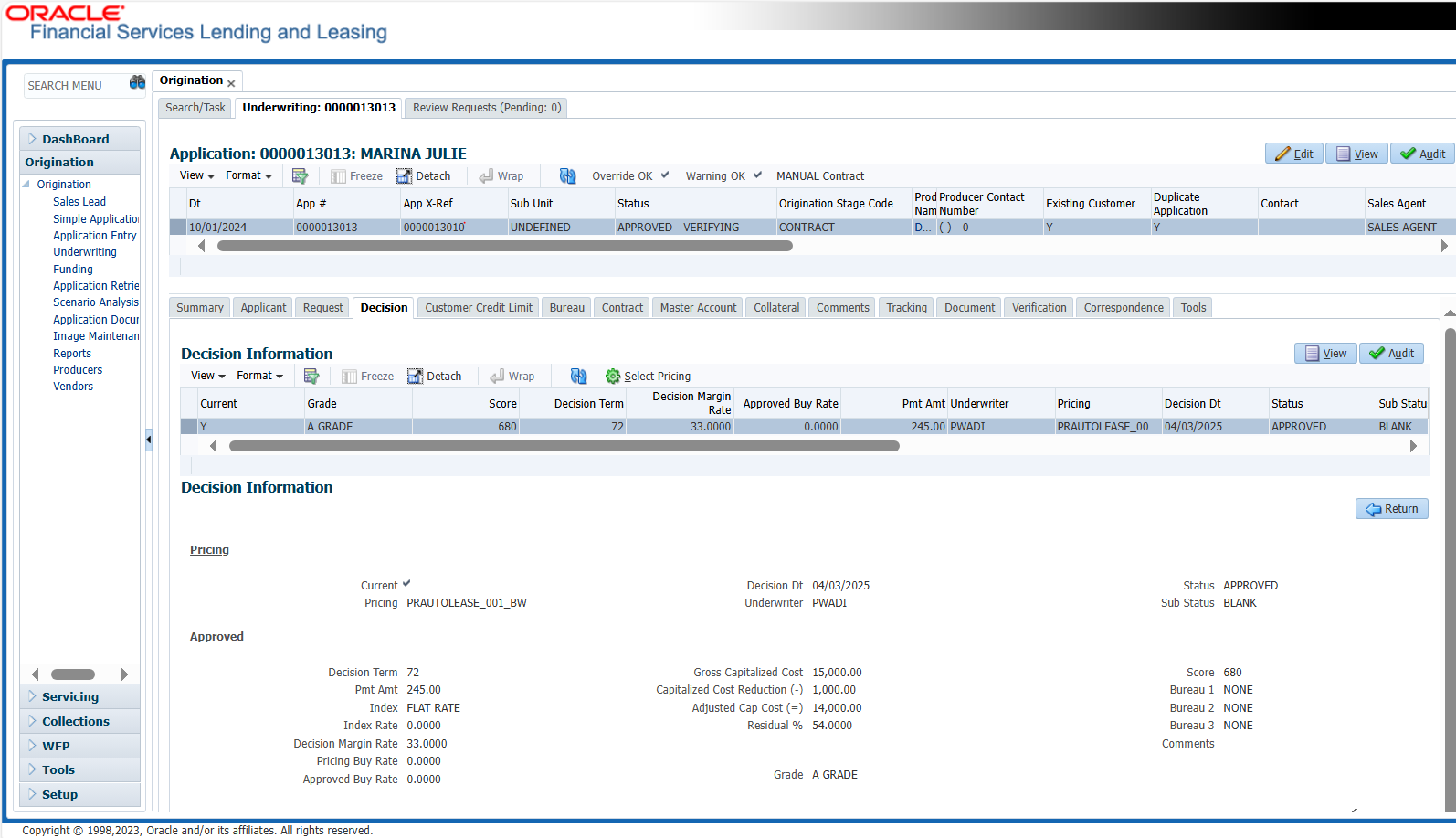

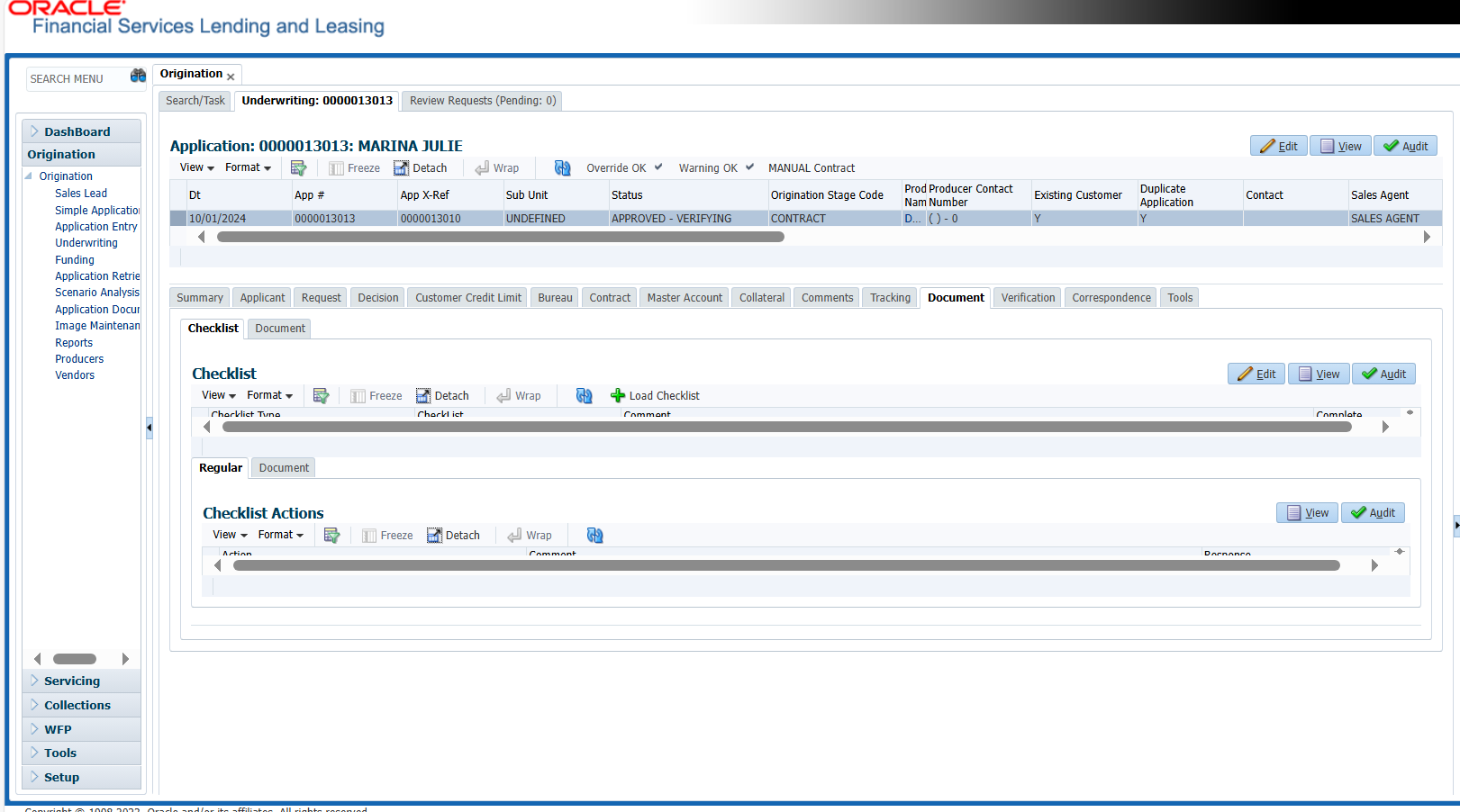

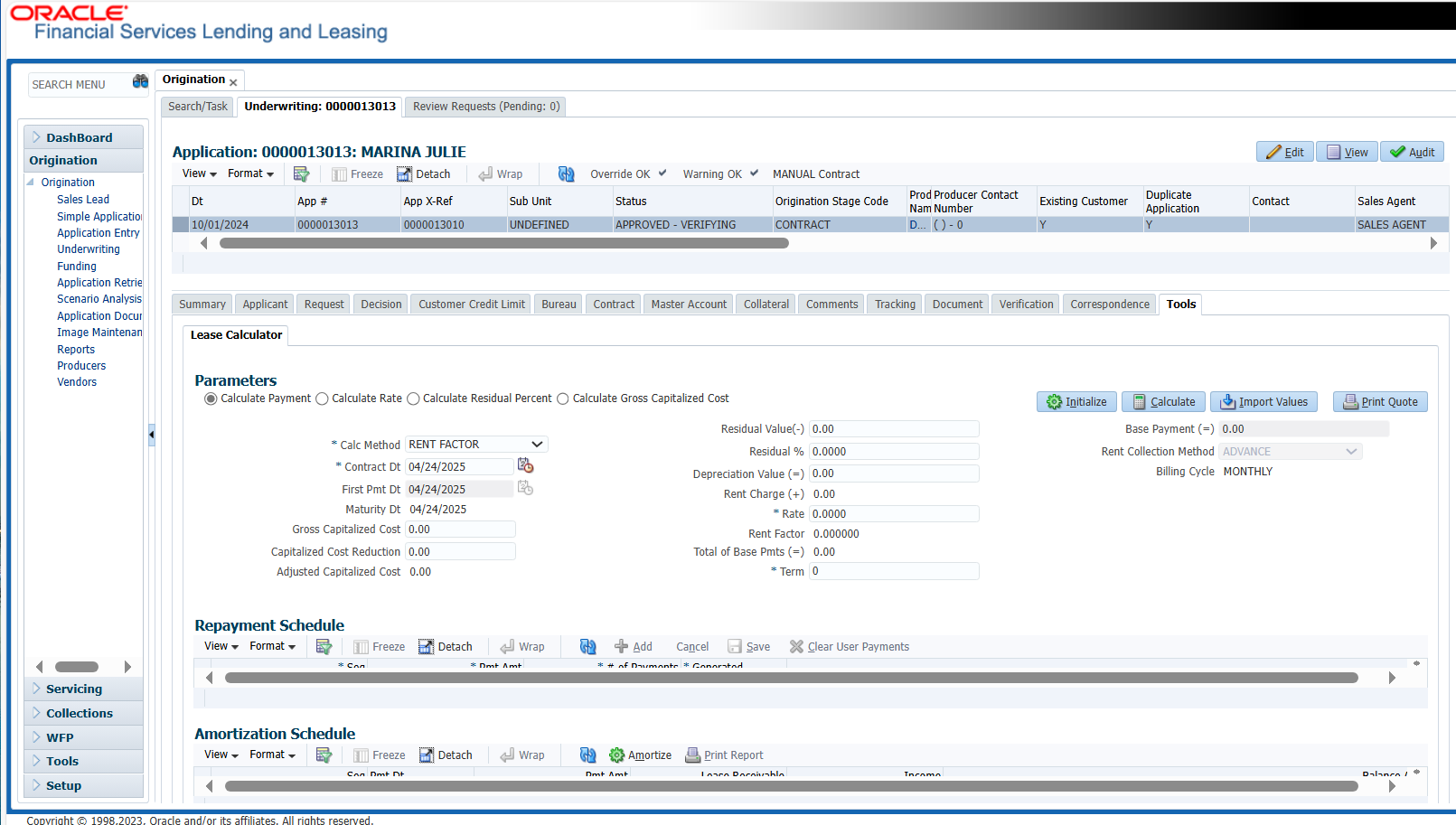

Get a Visual Tour of the OFSLL Lease and Loan Origination Software

*Note: The visuals shown above use sample data for demonstration purposes.

Key Feature of Loan Origination Software Module

| Feature of Loan Origination Software | Why It Works |

| 1. End-to-end loan application processing | Captures full workflow from initiation to approval |

| 2. Integrated credit bureau interface | Shows credit score integration and auto-decisioning support |

| 3. Automated underwriting/decision rules | Displays rules applied, approval/rejection, score overrides |

| 4. Multi-product & co-applicant support | Demonstrates support for complex applications |

| 5. Document management & checklist tracking | Visually shows document uploads, tracking, compliance |

| 6. Workflow & status tracking | Ideal for showing automated progression |

| 7. Custom pricing & offer management | Great for highlighting configurable offer structures |

DecisivEdge Addresses Your Loan Origination Software Challenges by Offering

Compliance Built into Every Step.

Regulatory expectations are increasing across consumer, commercial, and equipment lending. Whether it’s KYC, UDAAP, TILA, or local leasing laws, we configure OFSLL to embed compliance directly into your origination workflows.

- Automated disclosures and document generation

- Built-in audit trails that track every data change and decision point

- Configurable rules that evolve with changing regulations — without rewriting code

Improved CX - From Application to Approval.

Borrowers expect fast, seamless digital experiences — and lenders need tools to meet them there. Our customized origination workflows reduce friction at every touchpoint:

- Pre-filled applications and omnichannel access (online, mobile, agent-assisted)

- Instant or rules-based approvals for faster time-to-yes

- Configurable notifications and follow-ups that keep applicants informed

Actionable Intelligence, Not Just Reports.

Most origination platforms capture data. Few help you use it. With OFSLL, we configure real-time dashboards and deep analytics across your origination funnel:

- Monitor conversion rates, approval speed, and risk segmentation

- Identify bottlenecks by team, product, or geography

- Track credit performance by decision path to optimize underwriting rules

Key Benefits of Our Customized

OFSLL Loan Origination Software Solution.

DecisivEdge configures OFSLL to fully digitize and automate the loan and lease origination lifecycle — no more disjointed spreadsheets, email threads, or swivel-chair processing. From initial application and credit pull to underwriting, approval, document generation, and final funding, every step is orchestrated through configurable workflows.

You can build a customized underwriting workflow based on user-configurable parameters for a paperless flow of information. Additionally, submit and receive credit bureau information online; automatic parsing of the credit bureau information directly into the application.

Reduce processing times by days, minimizes human error, and free up your team to focus on strategic work instead of repetitive tasks.

Result: Faster loan turnaround times, lower cost per origination, and greater borrower satisfaction.

No two lenders are alike — and your loan origination software shouldn’t force you into a box. DecisivEdge customizes OFSLL to fit your specific lending products and operational model, whether that means high-velocity consumer lending, relationship-based commercial leasing, or embedded finance at the point of sale.

Approval hierarchies, exception handling, conditional logic, and partner onboarding can all be configured to match your process. Process checks through an external Accounts Payable system or send Automated Clearing House (ACH) payment(s) directly from the system.

Result: Greater agility to launch new loan and lease products, expand into new verticals, or adapt to policy changes — without costly custom development.

Speed, consistency, and transparency in credit decisions are critical to growing your portfolio without increasing risk. Link the origination data to funding processes and the servicing module in real time.

OFSLL’s built-in decision engine, fine-tuned by DecisivEdge, allows you to automate scoring, apply custom risk rules, and integrate with external data sources — including credit bureaus, fraud detection platforms, and internal customer data — in real time.

Result: Smarter decisions made faster, with full visibility and auditability across every application.

OFSLL’s architecture is designed with compliance in mind — and DecisivEdge brings deep domain expertise in embedding regulatory safeguards across origination workflows.

From customized credit guidelines, KYC/AML checks to electronic disclosures, e-signatures, and documentation tracking, we ensure your platform is always audit-ready. Role-based access, automated logging, and configurable retention policies further support data governance and regulatory reporting.

Result: Reduced risk of non-compliance and a stronger foundation for audits, exams, and ongoing regulatory change.

As you scale into new markets or offer new products, your loan origination software should empower – not restrict – you.

OFSLL is built for scale, and DecisivEdge helps you leverage its modular framework to onboard new lending partners, channels, and regions efficiently. You can introduce new loan types, roll out cross-border workflows, or spin up pilots without disrupting your existing operations.

Result: Scalable growth with minimal friction, no duplicate systems, and faster time to market.

Case Study: DecisivEdge Modernizes an HVAC Lender’s Lending and Leasing Software Solution

Microf, a national HVAC lender was looking to replace its inflexible, limited leasing software to enable its growth and diversification plans. After an extensive search and vetting process, they selected DecisivEdge to help out.

Given the unique nature of the lender’s business, DecisivEdge had to heavily customize their OFSLL instance, providing over 50 enhancements.

Results included almost immediate growth realization, a move away from manual process which in turn saved time and offered full regulatory compliance, as well as, freeing internal resources to now working on new financial products and improving their competitive position.

Industry-Specific Solutions for Enhanced Lending Performance.

OFSLL's Integration Partners