In my 30 plus years of experience in the financial services industry and working for large organizations in excess of $100 billion, regional banks, and community banks it seems all organizations to some extent had a silo approach in organizing information adding confusion to the decision making process. The problems centered on the following:

- Inconsistent Reporting

- Inconsistent or Non-Existent Profitability Measurement

- Inconsistent Risk Assessment

Addressing these problems is more essential now than ever before as the result of the highly competitive financial services industry in addition to the increased regulatory pressures as the result of the implementation of Dodd-Frank. A recent article in the American Banker points to the extent of the regulatory impact: Regulations Impose Severe Burden on Small Banks: Harvard Report.

An example of inconsistent reporting was brought to my attention during a discussion with one of our subsidiary CFO’s a few years back when I was asked what net interest margin number should she use from the reports which came from corporate reporting. There was some inconsistency with each reported margin number having its own reasoning. Personally, I thought the answer was fairly clear, “use the highest one.” This is just one example of what is a fairly common problem for most organizations large or small. Again based on my experience this is usually more pronounced in larger organizations. This is driven by the decentralized nature of the organizations structure, various product lines, and regionalized incentive driven compensation plans. I am a very strong believer in incentive based compensation, but you must be aware of the possible risks in the plans which you adopt. This is a topic in and of itself in a possible future post.

Inconsistent or non-existent profitability measurement is another area where financial institutions usually fall short. Years ago I worked for a fairly large regional bank who priced an acquisition on flawed transfer pricing assumptions and incorrect asset accrual techniques on a fairly large acquisition. It was an eye opening experience when the actual results did not meet planned expectations. One must understand the cash flows and how the acquisition is actually going to be consolidated in the firms consolidated financials. Funds Transfer Pricing is not an exact science, again one must understand its shortcomings.

The risk assessment process even becomes cloudier for financial institutions in how one measures the impact of its risk profile. One must first define the risk components. I like to keep things simple and believe risks can be consolidated under the following five headings:

- Market Risk

- Operations Risk

- Liquidity Risk (the ultimate nail in the coffin, usually the function of the other four risks)

- Interest Rate Risk

- Credit Risk

I believe we all understand the immediate impact of credit risk and with the improved and more widespread modeling, stress testing methodologies, and a scorecard approach for credit review at all sized financial institutions banks are getting a very good grasp on the inherent level of credit risk on their balance sheets. Just remember models have been wrong in the past and will have short-comings in the future. Just ask the rating agencies in the midst of the Great Recession. I assume you may have purchased some of those AA rated securities also.

Interest rate risk (IRR) has been around since the late 70’s as the result of added calculating capacity and the then S&L crisis which was driven by a very volatile rate environment and huge inflationary fears. All financial institutions measure IRR but measurement can be flawed through major shortcomings in a very intensive assumption driven process. I do believe IRR is a larger risk now than in recent history driven primarily by the drastic changes in all financial institutions deposit mix as the result of the prolonged low rate environment.

Are your deposit betas correct, how about prepayment assumptions on your large MBS portfolio, or is the static balance sheet approach the best way to measure the institutions IRR profile? I guess will see the results of this if we ever do get an increase in market interest rates. I always ask how valid is the back testing process if there are no movement in interest rates. The Fed Funds rate has been 0% to 25BP since November of 2008.

It is very difficult to determine absolute measures on the extent of operations risks which is present within all of our organization. Operation risk can be defined as the risk of monetary losses as a result of faults and errors in processes, technology, or external factors usually out of one’s control. Operation risk can include risks such a fraud, legal, regulatory, physical, and environmental risk. We all work at institutions where we attempt to limit the risk exposure through internal controls, disaster recovery plans, and highly tested systems and process. It is important that any changes in processes or systems are thoroughly tested prior to implementing these changes. A change management process must be in place. However, the absolute level of risk is difficult to define, for both small and larger organizations. Who would have dreamed the level of regulatory risk exposure banks are being exposed to currently? In every recent regulatory enforcement action there seems to be a standard comment relative to AML & BSA. The guidance which is offered by our regulators is also less than clear on how to measure operational risk exposure.

Market risk can be defined more clearly from a comparative analytical approach but this risk is usually smaller at regional and community financial institutions than large organizations who have more complex and widespread exposures.

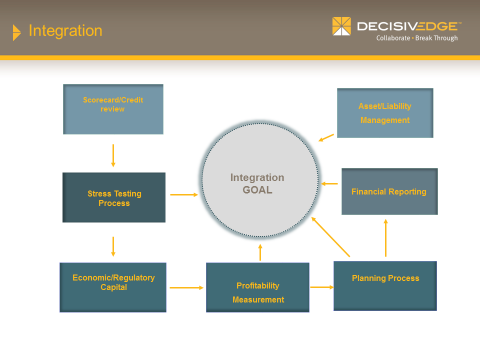

The diagram below shows a vision of integrating the key functions of the finance functions. A common data warehouse and common data sources should be the goal in meeting your integration goal. If this is accomplished efficiencies will be created across all functions. Costs will be reduced with consistent decision support tools. This is not a quick fix and will need extensive planning and may require bringing expertise outside of the organization.

In future posts I plan on addressing a roadmap with examples for solving the financial integration goal outlined above. I intend to detail the steps needed to accomplish the integration plan, and discuss how improving financial system integration will lead to increased margins and set a financial framework for relationship pricing and profitability.

What is your organizations vision for addressing the challenges of defining and measuring risk?