FAST | EFFICIENT | ACCURATE

DecisivEdge supports both DIRECT and INDIRECT LENDERS

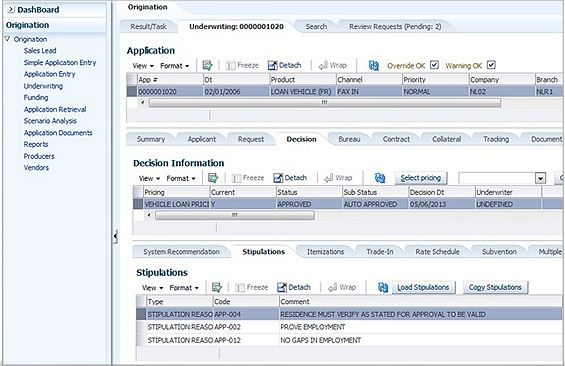

Accept, process and decision credit applications in a paperless mode

Quick credit scoring and automated decision making

Configurable credit guidelines to ensure regulatory compliance

Flexible workflow management for each stage in the lender’s underwriting processes

- Robust pricing strategies to drive market share and profitability

Powerful & Easy to Use Loan Origination Software

Lending & Leasing as a Service (LLaaS) origination software allows financial institutions to accept, process and decision credit applications in a paperless mode, with a single data entry process. All of these applications are controlled by a flexible workflow management system that can be configured to reflect the step in the company’s underwriting processes.

“Throughout the LLaaS implementation, DecisivEdge was much more than another vendor implementing software – they have been a true partner, helping us every step of the way through our complex project. The DecisivEdge team embraced the constantly changing regulatory and legal process changes and, on the night before go-live, went above and beyond to make our conversion successful. I value the support we were given and have been reaffirmed that we chose DecisivEdge for this difficult conversion.”

~ John Savage, CTO – Microf LLC

User-Friendly Loan Origination Software

Service oriented architecture (SOA) with a browser-based user interface

A back-end relational database, with a middle tier of business components

Provides a high level of configurability by using open standards-based middleware

Get unparalleled agility on a highly secure Oracle Cloud Platform; reducing the need for onsite data centers increasing operational efficiencies of lending and leasing processes

Supports your business with predefined processes that represent industry best practices

KEY FEATURES

Link the origination data to funding processes and the servicing module in real time.

Build a customized underwriting workflow based on user-configurable parameters for a paperless flow of information.

Submit and receive credit bureau information online; automatic parsing of the credit bureau information directly into the application.

Process checks through an external Accounts Payable system or send Automated Clearing House (ACH) payment(s) directly from the system.

Setup customizable credit guidelines within the system to ensure compliance.