ANTICIPATE | ORGANIZE | EXECUTE

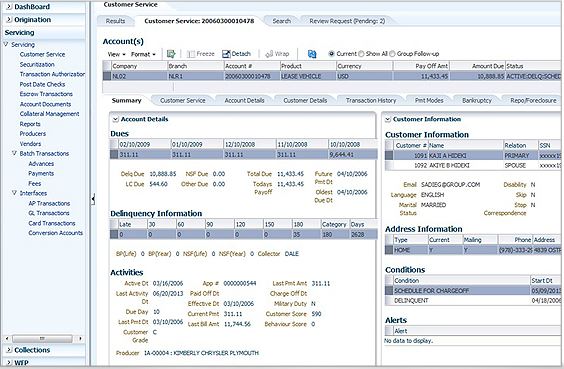

Loan collection software provides comprehensive functionality to support specialized collection-related activities

Tracks all occurrences and related histories associated with specialty collection activities

LPaaS loan collection allows 360° customer view with details to credit and repayment history with the lender

Allows detailed history of customer contacts, promises-to-pay and follow-ups

Configurable & Flexible Loan Collection Software

Lending & Leasing as a Service (LLaaS) Collections offers a full-featured Lending/Leasing suite of capabilities. It is the perfect fit for any financial institution interested in reducing delinquency, increasing collections on charged-off loans and streamlining processes, such as default management, bankruptcy, foreclosure, repossession and fraud tracking.

“Throughout the LLaaS implementation, DecisivEdge was much more than another vendor implementing software – they have been a true partner, helping us every step of the way through our complex project. The DecisivEdge team embraced the constantly changing regulatory and legal process changes and, on the night before go-live, went above and beyond to make our conversion successful. I value the support we were given and have been reaffirmed that we chose DecisivEdge for this difficult conversion.”

~ John Savage, CTO – Microf LLC

Innovatively Designed Loan Collection Software

The cloud service supports seamless data file integration, optimizing performance and enhancing data retrieval response times

From lease to loans to line of credit, the solution cuts across product lines

Choice of deployment options from cloud to on premise make it easy for your business to thrive

Improves productivity of the staff by its superior operational control and ease of product modification

Enables a quick response and improves the accuracy of credit decisions

KEY FEATURES

View a complete history of an account’s related financial information (this includes all financial transactions, payments, delinquency ratings, and credit bureau information)

Assign accounts for collection activity based on any or multiple attributes (the system allows the financial institution to define its own work process rather than forcing it into a specific approach)

Electronically route delinquent accounts to other users for action or review, such as forwarding for management approval

Enter, categorize and search unlimited comments and remarks; these fields are also time/date and user stamped, automatically

Generate reports on collections, bankruptcy, foreclosure, and repossession activity for variance information, repossession assignments by vendor