Streamline Your Loan and Lease Management Process

LPaaS streamlines the loan and lease application process. The loan management solution is easy to use, can be customized to fit your workflow and delivers a positive experience to your customers. LPaaS is built using the latest technology, has the ability to incorporate a rules engine that will allow for intelligent routing, and facilitates integration with third party applications.

Digital Lending Made Simple

For Lenders

For Lenders

- Lenders can now leverage a sleek and stylish UI that is customizable to match their existing digital presence.

- Lending Portal brings white label customization to ensure borrowers get a look and feel unique to every Lender.

- The Lending Portal is designed to enhance the borrower experience by providing lenders with exceptional automation tools.

For Borrowers

For Borrowers

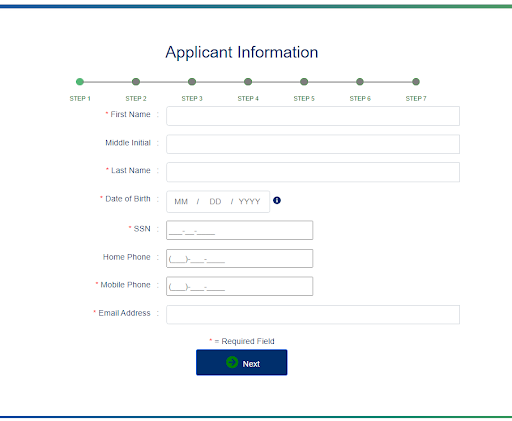

- Borrowers can expect a mobile-ready loan application with pre-fill capabilities and a direct line to tracking the status of their application.

- The custom portal solution included a flexible forms engine that allowed the customer to configure the lease application data collection process.

- Borrowers can browse programs and rates that match their unique criteria.

Key Features

Architecture

User Interface (UI) created in React and React Native for mobile

NoSQL Databases (MongoDB)

Interactions handled via APIs, Web Services and WebHooks

Encryption of secure information at rest and during transmission

Low-Code Solution allows for faster customization

Infrastructure

Configured to deploy to most cloud providers on Linux OS

Docker Containers to allow for easy deployment

Scalable infrastructure which allows for growth via multiple paths

Portal Functions

Customizable application flow allows for easy collection of data via a multi-step approach with quick navigation between steps

Integration with third party providers – examples include Docusign, Paymentus, OFSLL

Secure data capture and storage with custom data validation

The portal can be quickly adapted for any industry and has a well-defined process

Portal and Mobile Application can be branded with logo and color scheme

Authentication via User & Password or Single Sign-On (SSO)

User-Friendly Loan Management Portal

With speed and responsiveness as top priorities, our design considers all major browsers and devices to ensure maximal convenience and functionality

Integrates with the Oracle Financial Services Lending and Leasing application and other origination and servicing platforms

Offers freedom and control to customize application themes and wording

Configuration is made easy through our tool’s built-in white-label editor

Track the application status, upload documents, complete task lists and communicate with the lender

FUNCTIONALITY

Create customer internal users

Support for contractors/third party lenders and corresponding users

Role-Based access for all users to control access to portal features

Enter applications and complete the origination process if approved

Search existing applications and pick-up where you left off in the application process

E-sign the corresponding origination documents

Payment gateway integration to schedule automated payments

Allow for upload of additional/supporting application documents